What are Microsurveys: Best Practices and Examples

This is a complete guide to microsurveys.

It will show you what microsurveys are, and how you can use them to quickly collect specific feedback from users.

For most of us the word survey triggers quite a negative response. On hearing it, we, typically, picture a long, arduous activity that we have little to no time for.

That makes sense, by the way.

Most surveys tend to be long, after all. They ask us to dig deep into the topic and our experiences or feedback and answer long strings of questions.

And we rarely want to do that. Naturally.

But microsurveys are different. As you’ll shortly see, they share very little in common with those typical surveys we dread so much.

They are quick to complete. They don’t ask too many questions. And they are usually run in-app, making them super easy to complete.

So, without any further ado, let’s dive in.

What is a microsurvey?

When we use this term – microsurvey – we refer to a deliberately short survey that aims to collect quick feedback on a specific issue.

Because of that, microsurveys tend to be short, often focusing on just a single question. What’s more, often, responding to them requires nothing more than just selecting an answer from pre-defined options.

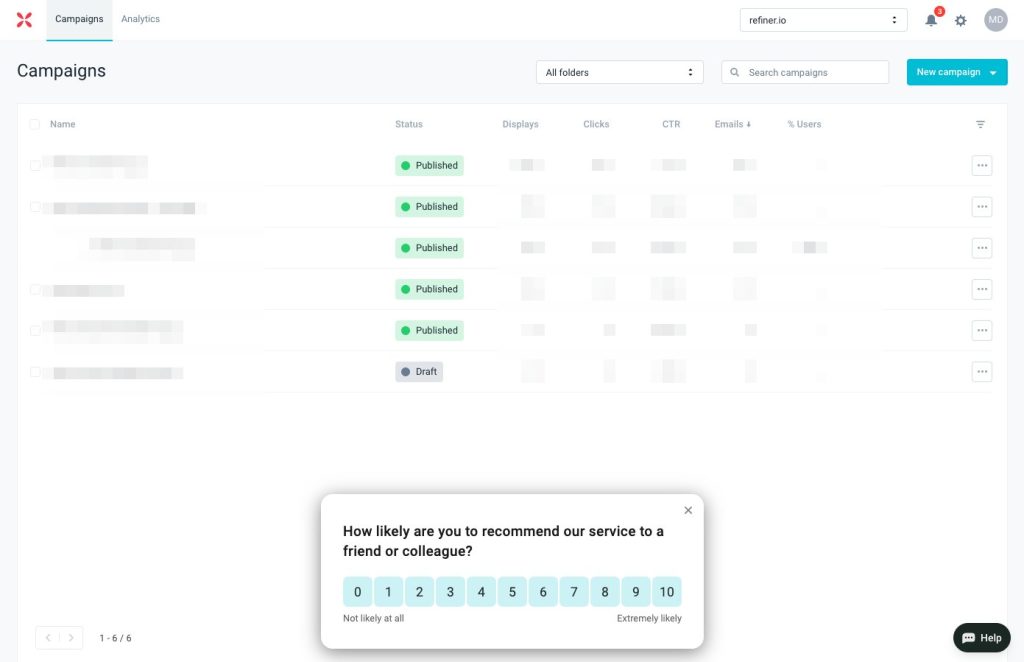

Here’s an example of a microsurvey, created with my tool, Refiner.

Note how simple this survey is. It’s just a single question with a simple rating system the person can use to provide feedback.

Now, compare that with a typical survey.

A stark difference, isn’t there?

Naturally, I am not saying that traditional surveys are bad. Far from it, in fact. But they can seem intimidating, and certainly require far more work than the microsurvey.

And that’s OK. Sometimes, to collect the information or insights you require, you need to ask several questions.

But sometimes, you might also just need to ask users about something specific, like wheter they’re satisfied with a new feature you’ve launched. And you don’t need an elaborate survey for that. You don’t even need an elaborate survey. You can just ask the question through a microsurvey triggered within your app’s interface, and have users provide immediate answers there.

And that’s exactly what microsurveys are for.

TLDR:

- Microsurveys are short surveys that focus on collecting user feedback on a highly-specific issue.

- Because of their laser-focus and simplicity, microsurveys deliver far greater response rates than traditional surveys.

- They usually focus on asking a single question and use simple reply mechanisms (i.e., rating, star rating, pre-defined answers, etc.)

- Some microsurveys might feature an optional follow-up question. However, this question isn’t necessary and whether users reply on it or not does not affect the survey’s results.

- Microsurveys are usually triggered in-app, making them the best method for collecting highly contextual feedback from users.

Microsurvey use cases and examples

Now, naturally, there are more reasons to run microsurveys than to ask about new features. So, let’s quickly run through the most common use cases, or types of feedback, that you can collect with microsurveys.

#1. Customer satisfaction

Most customer satisfaction surveys actually are delivered through microsurveys.

NPS, CSAT, CES, and other such surveys revolve around a single question, after all.

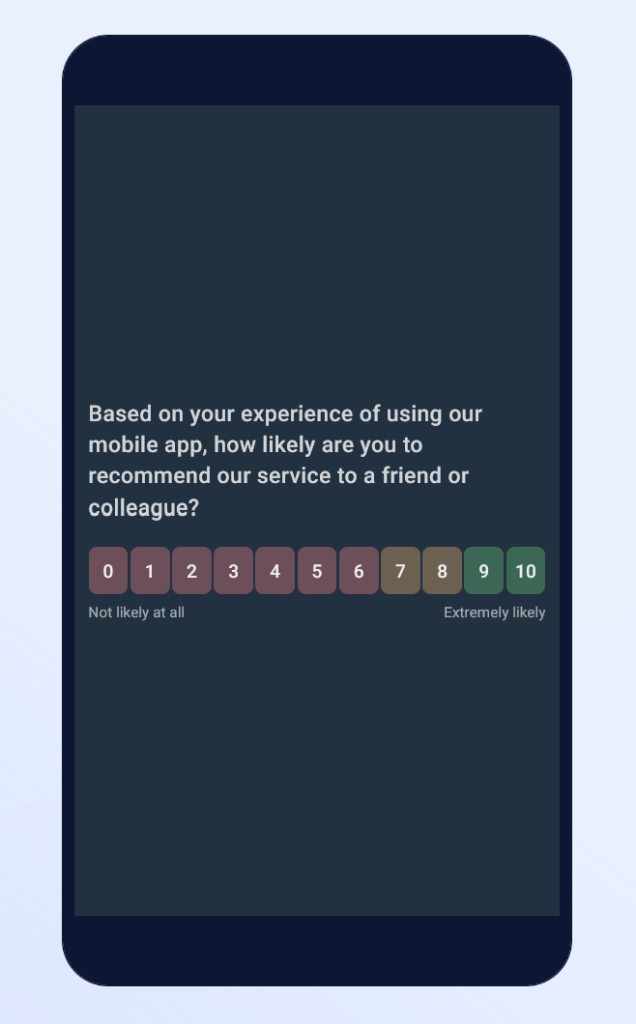

In the case of NPS, it’s “How likely are you to recommend our product to friend or family?“

CSAT asks about how satisfied a person is with a product or its particular aspect, and so on. (you can view an example on our CSAT template.)

What’s more, typically, these surveys are triggered in-app as a small widget.

Here’s an example of a microsurvey featuring an NPS.

#2. Product development

Microsurveys can also help collect a broad range of insights around various aspects of product research and development.

For example, you can use microsurveys to evaluate your product market fit. In this case, the goal for running the survey is to evaluate how useful the users find your product.

Here’s an example of a product market fit survey asking exactly that question (note, this is based on our product market fit survey template that you can start using right away.)

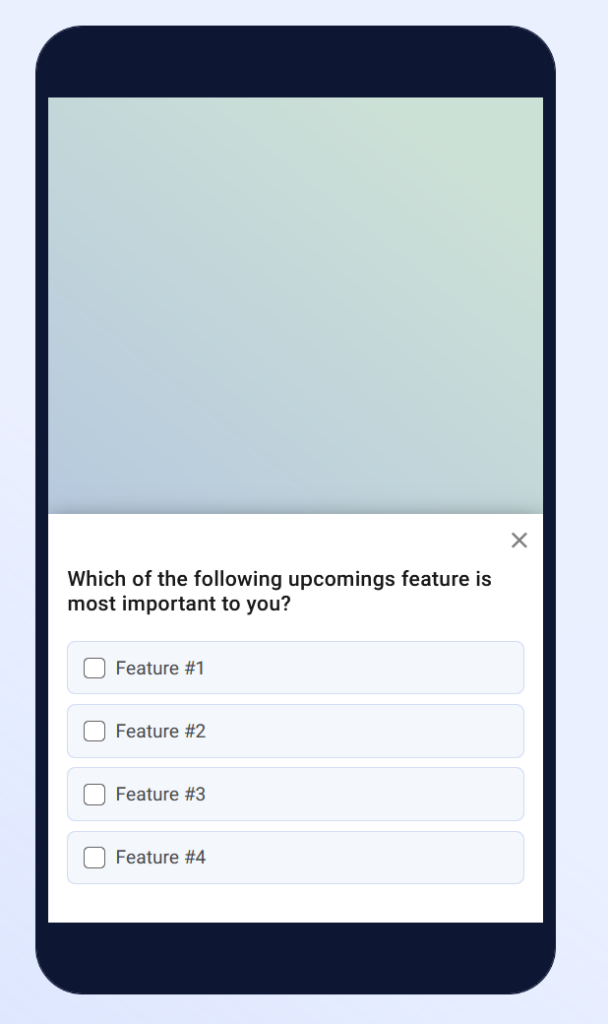

You can also use microsurveys to evaluate and prioritize new feature ideas. To do so, simply ask users to rate which new features they’d like added to the product next.

In the same vein, you can ask them to comment on recently launched features and tell you whether these work and deliver value as intended.

(And even that is just the tip of the iceberg of how microsurveys can help you improve and develop a better product.)

#3. Customer feedback

One of the most incredible ways to use microsurveys is to collect quick customer feedback such as competitor analysis.

With these surveys, you can find out which aspects of your product users find the most valuable. Or which features they use more frequently than others.

You can also find out why they’ve chosen your product and not the competition. Or which competitors they’ve evaluated aside from you, to build the idea of whom you are really competing against in the eyes of your audience.

#4. Market and audience research

One of the challenges we, founders and builders of software and digital products, face is that we rarely get to see and interact with our users.

A B2B service provider, for example, almost always meets with and builds at least some relationship with a potential customers before they buy. It’s the part and parcel of the B2B sales process, after all.

But with us, most users sign up by themselves, explore our product on their own, and convert to paying customers without ever interacting with us even once.

Unfortunately, this means that we often know very little about the people using our products. Hell, often, we can’t even tell with absolute certainty whether our marketing efforts attract the right people.

Luckily, this is something microsurveys can help us overcome. We can trigger short surveys to learn more about our users.

We can ask questions that will help us understand our customers better , or even understand whether they match our ideal customer profile.

We can learn more about why they’ve decided to use our product, and what pain point we help them overcome.

Finally, we can use microsurveys to identify potential customers to upsell on higher plans , and more.

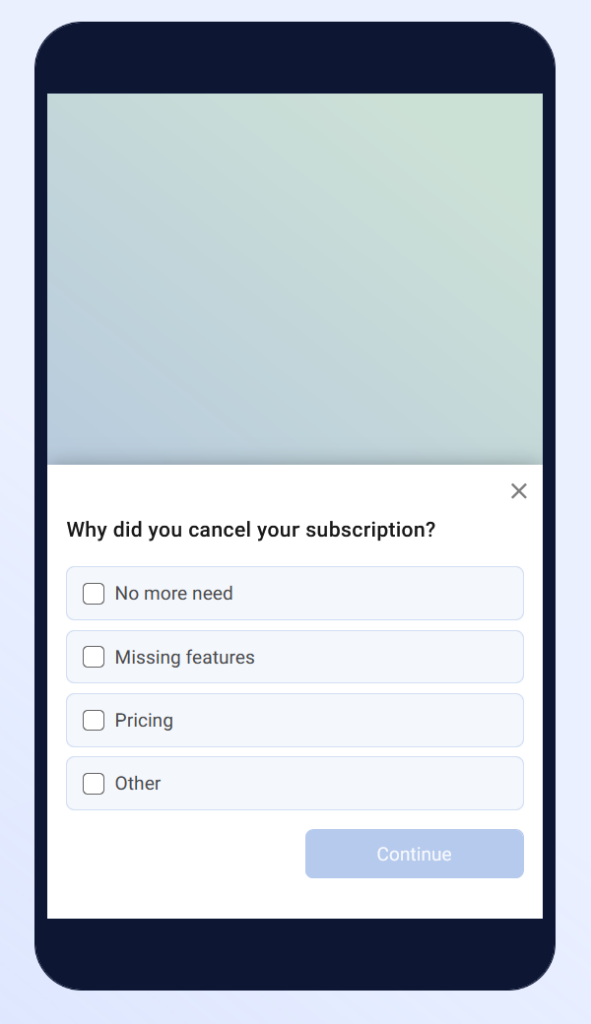

#5. Churn surveys

Fact: Churn is an unavoidable part of our reality. Sure, it’s not something we’d like to experience but there’s no point in denying, some users will decide to stop using our products.

But every churning user is an opportunity learn more about what made them decide that our product isn’t for them, and that’s what you can find out with churn surveys.

A churn survey is a short questionnaire you ask a customer to complete when they decide to stop their subscription to your service.

Because you’re dealing with churn, such a survey is best triggered exactly when the person cancels their subscription, and right within the app’s interface. After all, there is little chance that they’d want to explain their decision after the fact.

But just at that very moment, they might be willing to tell you quickly why they’ve decided to cancel, and microsurveys are the best strategy to collect such a feedback.

How to run a successful microsurvey

We’ve covered quite a lot of theory about microsurveys. You know what they are and when to use them (or what type of feedback to collect with them.)

So, let’s now focus on what you need to do to launch a successful microsurvey.

And note that I said successful.

That’s because it’s easy to launch a survey. In most cases, you can use a pre-defined template and be off to the races.

But launching one that users will want to respond to is another matter. And for the most part, it requires that you focus on its several elements:

#1. Goal

I’m sure this sounds cliche but you must have a reason to run a survey, and unfortunately, “to collect user feedback” isn’t a good one.

Remember, a microsurvey works best if you use it to collect highly-specific information and insights. It’s also ideal for collecting just one type of insights.

So, at the start, find your why for running the survey.

TIP: If in doubt, base your goal on the use cases and examples I included earlier in this guide.

For example, you may want to learn what users think about your product. To do that, launch surveys that uncover your customer’s satisfaction – NPS, CSAT, or CES.

If you currently focus on product development, try some of the surveys from that category, and so on.

IMPORTANT – My microsurvey tool, Refiner, comes equipped with many useful survey templates across all these categories.

You can use those to quickly launch relevant surveys. And you can always tweak and customize each survey to your specific goal, too.

#2. Question format

If you’re using a pre-defined template, then you don’t have to worry about this element. The template will feature the correct question format right away.

However, if you’re writing the survey question yourself, then you need to ensure that you’re using the format that first of all, matches the question, and makes it easy for users to respond.

In general, we use four different question formats in microsurveys:

Binary questions, otherwise known as yes-no questions, that ask for something the person can reply with either “yes” or “no.”

Example:

- Are you enjoying using our product? (Answer: Yes/No)

Rating (or Likert scale) questions that ask respondents to indicate the extent to which they agree or disagree with a given statement.

Example:

- On a scale of 0-10, how would you rate the support you’ve received?

Star or other type of ratings. This is a variation of the Likert scale question, however, instead of choosing numerical value, the person indicates their preference based on a number of stars where the more the stars selected, the more positive the response.

Example:

- How would you rate the support you’ve received?

Ranking questions that ask a person to compare how they feel about a group of factors to each other.

Example:

- Rank these features by the order of importance to you. (Answer: A list of features with a rating system beside each.)

#3. Targeting and timing

It’s only natural – You want to collect useful user feedback and so, you decide to display the microsurvey as soon as the person logs into your app.

But the trouble is that depending on your goals, that might be far too early for the person to see the survey.

Perhaps launching the survey right away would interrupt their flow (and in turn, negatively affect their response.) Or the survey would appear at a time when their response wouldn’t be given in context of the question. A good example of this is launching a microsurvey asking about a specific feature when the person is using another feature. It’d make no sense, right?

The same rule applies to whom you’re displaying the survey to. Again, the most obvious option is to show it to every user. But the thing is, not every user can provide you with the relevant feedback.

For example, I often see companies triggering NPS surveys to users who have just signed up for the app. These people haven’t had the chance to even familiarize themselves with the interface, let alone truly experience the value of the product.

And yet, the company expects them to decide whether they’d recommend it to others. Idiotic, if you ask me.

That’s why, for your microsurvey to succeed, you need to time it correctly and target the right audience.

Your microsurvey tool, most likely, offers a whole range of targeting options, including trigger events.

Trigger events let you define at what moment the survey is shown to users in your Target Audience.

In my tool, Refiner, you can choose between time delay, page visits, or event-based triggers, or launch surveys manually.

And that’s it…

That’s all you need to know about microsurveys to start using them to collect incredible user feedback.

Good luck!