What is Product Research: A Guide for Founders

I don’t think there’s ever been a founder who succeeded with the first iteration of their product idea. For most of us, building a product means constant discovery and iteration, or product research, for short.

In this guide, I’ll explain what product research is and show you the best methods to do product research for your startup.

And there’s a very good reason for you to keep on reading…

We, founders, have really just one objective, after all – To create a product that will pretty much rock our customers’ worlds.

Sure, we can say that we want to exit and get a bucket load of cash for our product.

Or that we want to conquer the world.

Or build another SaaS unicorn…

And even if that is the case, we still need to build that perfect product first. Perfect in a sense that our customers won’t be able to live without it.

The thing is – It’s almost impossible to do it right off the bat. No matter what ideas we have, we still need more insights, data, and feedback to fine-tune it. And the only way to get it is through product research.

Below, I’ve included what I know about it, and what I’ve done to create Refiner. Full disclaimer, I also plugged my product there because, let’s be fair, it does help with product research too.

But on the whole, the below guide contains what you need to know about product research to refine your idea and build a product that’ll delight your audience.

So, let’s get on with it, then.

What does it really mean to conduct product research?

I ask this because the term – product research – could, at first, be misleading.

It’s easy to consider it referring to the process of researching products to buy, for example but that’s not it.

So what is product research? Various definitions call it a process focusing on gathering insights and information that, once analyzed, can help us build and improve our products.

There is far more in making it happen, of course. However, on the whole, I think that’s probably the easiest way to explain what product research is.

But…

There are several other reasons to conduct product research beyond just learning what your users want.

- Product research is your gateway to becoming a user-centric company. It’s how you understand the target audience, their needs, pain points, and desires, and develop products that meet those requirements, rather than do what you’d like them to do.

- Secondly, product research also helps you validate ideas and assumptions. This last item is of particular interest here. After all, how often do we come up with ideas, and then rationalize them in our minds by assuming certain things about our audience or their needs? Now, these assumptions may as well be true. But you can only know that if you’ve validated them through product research.

- Thanks to different product research methods (more on those in just a moment), we get to find out which features our audience really want us to build. And needless to say, that’s a huge help that can also prevent us from spending time and effort on the wrong feature.

- Finally, product analysis can tell us a whole lot about our competitors, far more than other research methods could uncover. Why? Because through product research, you learn what your customers think of the competition. You discover how they perceive other similar products on the market, what value they (meaning, your customers) think those products deliver, and the reasons why they could consider using those products.

Worth to note – Product research is an iterative process. It’s not something you do once and then, forget about it but a continuous process that helps you refine anything from questions you ask to insights you collect.

As a result, product research is also quite an undertaking. It’s not something you should be doing on a whim, or to plug leaks in your funnel. Instead, product research is a process you should do continuously, and tap into those insights when you need data to fuel a specific project (like plugging leaks in a funnel, for example.)

In other words, product research is where you continuously collect data that you then turn to when needed, not the other way around.

So, how do you do it, then? How do you collect product research data?

Product research methods

Let me start by saying that there is no single, ideal product research method. It’s also impossible to tell which product research method is better than others, and so on. All of the methods I’ve listed below work exceptionally well in their respective best use case scenarios.

But as you can imagine, I’m still a little biased towards surveys. That’s what my product, Refiner, does, after all. Surveys are also the method I’ve used the most in the past, and that’s what helped me drive the development of Refiner.

Nonetheless, here are all the most popular product research methods, including surveys, of course.

Surveys: Surveys rely on you sending questionnaires to a pre-selected audience segment to collect quantitative and qualitative data about those people’s opinions, insights, and so on.

What makes surveys so incredible for product research is their:

- Wide reach – You can send a survey to a large number of people, and collect insights from them without much effort.

- Scalability – Similarly, surveys don’t require additional time or effort from you to scale the research.

- Low cost – Again, surveys are relatively inexpensive to run.

Some of the most common product research surveys include:

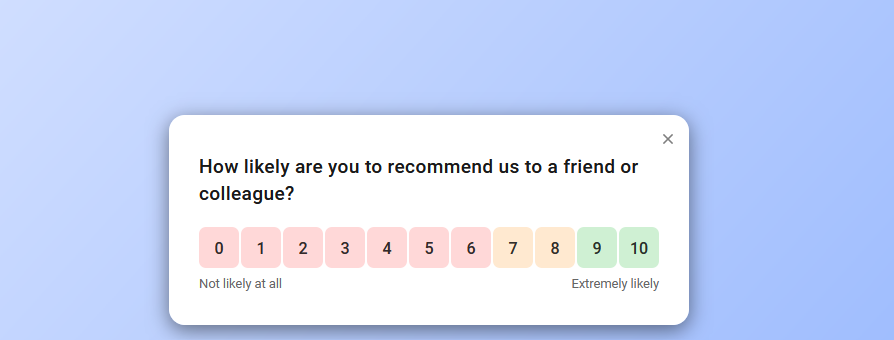

- NPS – a survey that allows you to evaluate the customers’ attitudes towards your product.

- CSAT, which helps you learn more about your customer satisfaction and draw actionable insights based on that.

- CES which reveals how easy (or not) customers find your product to use.

Here’s an example of an NPS survey used in product research.

FEATURED READING: How to run a perfect customer survey for a digital product

User Interviews: This method is all about sitting down with your customers one-on-one to discuss their needs, uncover pain points, or their product preferences. User interviews are all about asking open-ended questions and letting the person reveal their opinions. Unfortunately, this makes it a time-consuming method for product research, particularly if compared with surveys.

Focus groups: Running a focus group is like conducting user interviews at scale. In this method, you bring a small group of users together to discuss your product, provide feedback on issues you want to research, and so on.

Usability testing: This method focuses on observing users as they interact with the product (or its prototypes.) By observing how users complete predefined actions in the product, you can identify usability issues and gather insights for improvement.

User behavior tracking: In this method, you’re also drawing conclusions based on user behavior. However, unlike usability testing, behavioral tracking focuses on analyzing data that you collect using different user behavior tracking tools (like Hotjar, for example) to understand user behavior, spot patterns, and collect benchmarks.

A/B testing: A/B or split tests allow you to uncover the audience’s preferences by eliminating product or UI elements that fail to engage them successfully. In this product research method, you present different versions of a product to different user segments and monitor their engagement with those to determine which variation performs better.

Customer journey mapping: This method relies less on collecting specific insights than using your data so far to understand the entire customer journey, from initial product discovery to post-purchase experience. This is an important product research method, as it allows you to map pain points to specific stages of the buyer’s journey, and spot opportunities for improvement.

How to conduct product research – Key elements of a product research project

It’s quite easy to assume that to launch a product research project, you just need to, a.) pick a research method, and b.) figure out how to use it, and off you go but no, that’s not how it works.

Successful product research strategy relies on several key elements:

Clearly defined objectives

It’s as obvious as it sounds, actually. For your project to work out, you need to set specific objectives and communicate them in a clear and understandable way. These objectives will guide the entire project, from selecting the target audience, research method, to what you’re going to do with the data.

Specific target audience

Again, quite an obvious element but also, often one that we tend to forget about. Naturally, we always have an audience for research. There is no such project without it, after all. But at the same time, we often tend to jump in and invite all customers for research, whereas we should be gathering insights from a specific audience or customer segment only.

This product research element focuses on selecting the right people who have the insights and knowledge that you seek. For example, if you’re evaluating advanced product functionality, you should focus exclusively on experienced users. New users mightn’t have even discovered those advanced features. And even if they did, their level of product knowledge mightn’t be sufficient for them to provide any meaningful insights for your research.

Research method

In most cases, once you set clear objectives, and pick the target audience that has insights to help you achieve those, choosing the research method is relatively easy. But you still have to do it. And I recommend that you evaluate all potential options (we’ve covered them above,) and select the method that’s the most appropriate for your goals and the audience.

TIP: It pays off to select several research methods sometimes. For example, if your goal is to improve the usability of your interface, you might start by tracking user behavior to identify potential challenges users experience. Then, hold usability sessions to confirm your assumptions, and finally, interview most engaged users about their challenges.

Notice how each method in this example allows you to go deeper into the problem. You start by collecting data that allows you to make hypotheses about potential usability problems. You, then, observe how users engage with those tasks in real-life, and finally, you get their opinion about those challenges.

Research instruments

I have to be honest – I’m not particularly fond of this label, research instrument. It’s quite misleading. But that’s what it is so I’m sticking with it here too. However, what we really mean by research instruments are materials that you’re going to use in the research methods you’ve selected.

These can be questions that you’ll be asking customers to answer in a survey, tasks for the usability session, questions for user interviews, and so on.

And needless to say, these are hugely important to prepare upfront, test, validate, and only put into use when you’re absolutely certain that they can deliver the insights you’re after without causing any form of bias.

Panel recruitment

In an earlier step, you’ve selected your target audience. Now, you need to recruit at least some of those people to participate in your product research. How you’re going to do it will largely depend on the research method you’ve selected.

For example, if you’re using behavioral data like heatmaps, then you don’t really need to recruit anyone for the study. Whatever heatmap software you’ll be using will collect the data for you.

If you run a survey, then you, most likely, will email it or display the survey in-app to your customer segment. Again, it’s not going to take much time and effort.

But the situation is different if you plan to run a user group, for example. In this case, you need to go through a formal process of approaching participants, getting their consent to participate in the study, and so on.

IMPORTANT: Note I mentioned collecting user consent before research. This is a hugely important step to remember, particularly in the face of GDPR and similar privacy laws.

As Phil Hesketh of ConsentKit explains:

“To ensure your research panel is compliant with data protection regulations in your country or state, it’s essential that you get consent from each panelist to collect and store their personal information.

You’ll need to get consent when a person agrees to join your panel for the purposes of recruiting for research, and you’ll need to ask for consent again when they agree to take part in a specific project.”

Data collection

This element is all about launching your research method to collect the data. Simply.

Data analysis and insights synthesis

In a typical product research project, you collect data for a specified period of time, after which you begin to analyze and synthesize that information. The goal here is to identify patterns, trends, and specific insights within the data, and document those so that you have a clear record of your findings.

Actionable insights

The project, typically, concludes not with documented data but a list of actionable recommendations drawn from it. In other words, with product research, you complete a full circle, starting with a problem, conducting research to generate data, and ending up facing the same problem again. This time, however, you’re equipped with insights and actionable recommendations to tackle it successfully.

And that’s it

That’s a typical product research project in a nutshell.

Naturally, there is more to each of its elements than I was able to fit into this guide. But I’m hoping that I was able to provide you with a solid foundation and general understanding of the process.

Also, if you’re interested in digging deeper into how to use surveys for product research, I recommend the my other guides:

- Product discovery process – the do’s and don’ts

- How to collect and measure user feedback for a digital product

- How to use UX research surveys for product development

- In-app feedback – How to capture user feedback within your app

- 15 best product feedback tools to help you improve your app

And if you want to see how Refiner, my survey software, could help you run successful product research surveys, sign up for a free trial or check out these live survey demos.