This is How to Collect and Measure User Feedback for a Digital Product

This is probably, the most complete guide to collecting user feedback for a digital product.

Below, you’ll find information about why and how you should ask users for feedback, what feedback collection methods work best, and, of course, what are the best tools to use to learn what customers think about your product.

And let’s begin at the beginning…

Let’s define user feedback first

Browse online for this term – user feedback – and you’ll find so many different definitions.

Some sites call it experience data from customers. Others refer to it as customer impressions, and so on.

But if we skip any of those semi-academic attempts to define user feedback, we quickly realize that it’s nothing more than the customers’ telling you what they think about whatever aspect of your product or business you’ve asked them about.

It’s that simple.

(BTW, note that the key phrase here is “whatever aspects of your product you’ve asked them about.”)

But I’ll even go one step further. You see – When it comes to user feedback, what it is isn’t as important as why you do it and what you do with the data.

So, let’s touch on that, then.

Why should you even bother with collecting user feedback?

This is where things get really interesting.

You see – The reason you collect user feedback (or you should be doing it) is that as a founder, product manager, developer, etc., you NEVER see your product the same way your customers do.

You can think that you do, but…

- You, most likely, don’t use it the same way they do. The chances are that you don’t use your product at all. You’re not the target audience, after all.

- As a result, you don’t experience the same value of using your product as they do. You probably, don’t even perceive that value at all, at least not beyond a gut feeling.

In short, you never look at your product the way customers do.

Even though it may seem insignificant, your inability to put yourself in your customers’ shoes, so to speak, has some serious implications for your product:

Take a product roadmap, for example. Without seeing the product as users do, it’s easy to start following your own ambitions for it, rather than focusing on addressing customers’ pain points.

One digital product after another has been guilty of launching features that its founders wanted to build (but nobody else really needed.)

(I know what I’m talking about – I made such mistakes in the past too.)

Another example – User experience. Since you designed the interface, for example, everything it is logical to you. But the chances are that you’ve created it to match the way you think or use products, not the way others do. The result? A UX that you consider perfect but others struggle with.

Now, the above is quite an extreme example. But even if you consider poor UX regarding the signup process, the implication on your business would be the same.

This is where user feedback comes into play.

I might ruffle some features by saying this, but so be it – User feedback IS the only way for you to experience the product as your customers do.

And it doesn’t matter how long you’ll spend using it and pretending you’re a customer. You’ll never get it as they do unless you collect user feedback.

In short:

- User feedback is your gateway to understanding what they feel and think when they use your product.

- Only through user feedback can you see the challenges they encounter (and what aspects of it they love like crazy!)

- And needless to say, it’s the only way to collect actionable insights that can help you build a product that works for customers, not you.

This brings us to a common misconception about it.

User feedback does not mean just surveys

To most people, the idea of collecting user feedback is synonymous with surveys.

And, of course, surveys play a huge role in the process. But this isn’t the only type of customer feedback.

So, over the next several sections, I want to discuss different aspects of this problem – different approaches, methods, and timeliness to use.

Let’s go.

Four approaches to collecting user feedback

You can actually collect feedback from customers in the following ways:

1. Active – This is when you take charge

In this approach, you reach out to customers or specific customer segments at specific times or after specific interactions you’ve identified to have significance to whatever aspect of the product you’re researching.

Examples of a proactive approach:

- Surveying new users about their signup experience.

- Sending NPS surveys to highly-active customers.

- Sending CES surveys after a customer completes a specific action in the product, etc.

2. On-demand – This is when you let users take charge

Finally, in this approach, you let users take an active role and provide feedback when they feel like it. This may mean allowing them to leave feedback through a dedicated widget or vote for new features.

3. Passive – This is when you observe and don’t interact with users

The passive approach is more about observing what customers do and how they interact with the product. In this case, instead of asking customers for feedback, you monitor what they do to draw conclusions about their experiences.

Example:

- Monitoring customer usage data to identify points of friction.

- Using screen recording to analyze customer behavior.

4. Ongoing – And this is when you observe all the time (but still don’t interact with users)

Ongoing user research also focuses a lot on observation methods. In this case, however, the research does not conclude and continues delivering new insights.

Example: Collecting user behavior data.

The five methods of collecting user feedback

I imagine this section will get the most engagement, and for a reason. I suspect you’ve made a decision to explore collecting user feedback before reading my guide. What you want to know is how to do it.

So, here goes. There are six primary methods for collecting user feedback that work particularly well for digital products.

Surveys

I’ve already mentioned that user feedback does not equal surveys. But at the same time, this is one of the key methods to collect feedback when needed actively.

For a digital product, you have the option to use several types of surveys, actually:

- In-app surveys that you display inside your product and survey customers as they engage with your app.

- Periodic surveys that you send customers regularly to evaluate their attitudes toward your product

- Transactional surveys you send after a specific interaction with your product or business (i.e., after a customer support inquiry, etc.)

And when it comes to what types of customer satisfaction survey questions to ask, here are your best options:

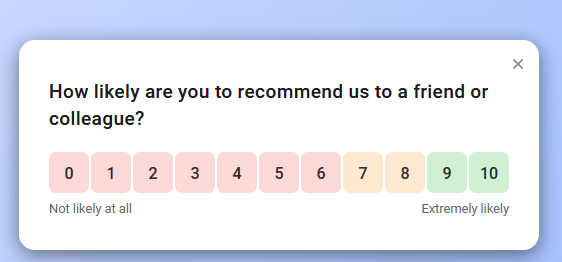

Net Promoter Score® (NPS) – An ideal survey if you want to evaluate customer experience based on loyalty and identify how many satisfied customers you have.

In NPS, you evaluate the likelihood of someone recommending you based on their overall experience with the product. And based on their response (using a 0-10 rating), you sort them into Promoters, Passives, or Detractors of your brand.

Example:

FURTHER READING: What is NPS?

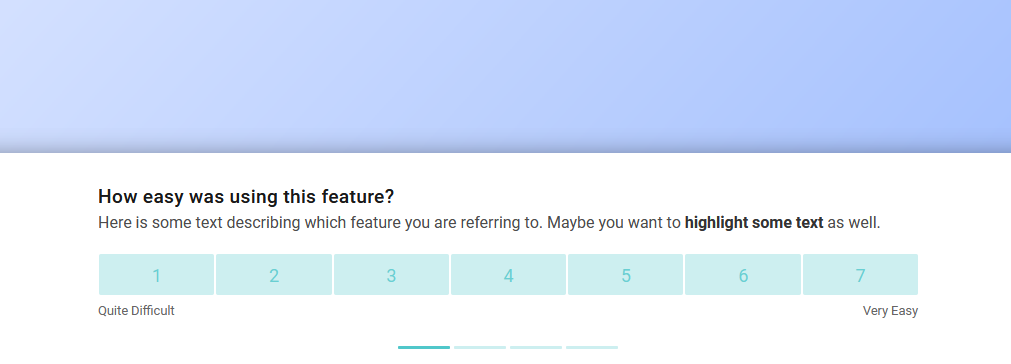

Customer Effort Score (CES) – A survey that helps you evaluate how easy it is to use or interact with your product. With CES, you can quickly identify friction points in your product experience.

In the CES survey, customers rate the effort it takes to use your product or use specific features and reveal whether your product is easy or complex to use.

Example:

FURTHER READING: What is CES?

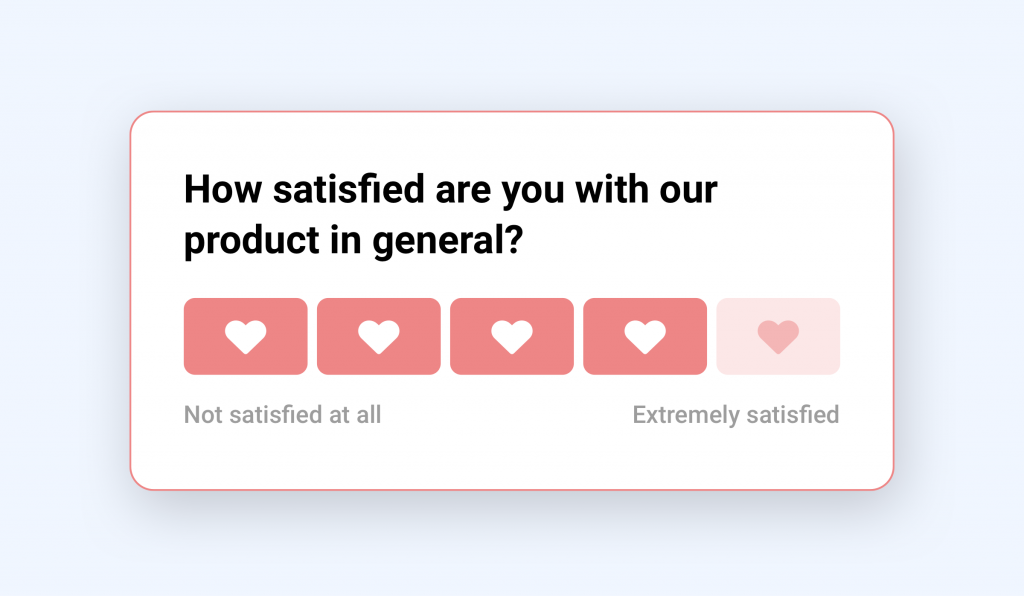

Customer Satisfaction (CSAT) – As the name suggests, this survey will help you evaluate how satisfied your customers are with your product.

CSAT was designed to help you understand how satisfied the customers are with the product, service, or overall experience you provide.

Example:

Product feedback – A product survey is a survey you send to segments of your audience to gather their feedback about your product.

For example, you can run a product survey to your most loyal users to find out what they like about your product and what you can improve.

You can also run a product survey to the users who are about to churn to spot any patterns on the reasons they stop using your product.

Product surveys allow you to access real data to shape your product roadmap based on what your audience really needs.

Example:

FURTHER READING: The Ultimate Guide to Product Surveys

User Interviews

In this method, you sit with customers and discuss their experiences, impressions, and opinions about your product.

What makes this method more effective than surveys is that you get a chance to probe deeper and uncover specific insights about your user’s experience. On the downside, this is a heavily time-consuming method, requiring you to spend significant time with every customer you plan to interview.

Observation

Observation is all about monitoring and analyzing user behavior data. And you have several ways to do it here. The most common are heat maps that let you visualize user behavior and recordings where you can see what your users see and observe them as they interact with your product.

Feature requests/Feature voting

This is probably, the most common of the on-demand methods. It’s also one of the most effective ones, I guess, far better than feedback widgets. One reason is that customers turn to widgets when they have something negative to say. Perhaps they found the UI confusing or couldn’t make a particular feature work.

But with feature requests or voting boards, they share positive experiences. With these user research methods, you give customers a voice and help them tell you exactly what they need you to build next.

Here’s a feature board my friends at FeatureUpvote are running and where their customers vote on the next features.

Focus Groups

I don’t hear of digital products and SaaS companies running focus groups often, and I suspect it’s mostly because of the effort involved. Yet the fact remains – Focus groups offer an incredible opportunity to see your product how customers see it.

In focus groups, you bring a group of customers together and conduct an open discussion about their issues and concerns about your product. But there’s even more to that. As the Nielsen Group wonderfully points out,

“Focus groups often bring out users’ spontaneous reactions and ideas and let you observe some group dynamics and organizational issues. You can also ask people to discuss how they perform activities that span many days or weeks: something that is expensive to observe directly.”

And here’s when to use those methods

There are actually two schools of thought regarding when you should be conducting user research, and both are somewhat right.

One school says that you should do it all the time, simply. Your user research should never stop.

The other, however, defines the schedule more precisely and says that you should use a different schedule for different research methods.

As I said, both are right. Some research methods should always continue (think about observation methods, for example.) But others work better if you have a goal behind launching them.

So, let’s go through some of the instances when you could launch those occasional research projects.

- Pre-product. In this case, the user research would aim to uncover what customers would want from the product you intend to build.

- Roadmap prioritization. One could argue that running a feature voting board would constitute ongoing research (and it’s probably true.) But you could also run separate research to validate which of your current ideas should end up in the product roadmap.

- Onboarding. Surveying new customers would help you evaluate their experiences with the signup process and figure out any points of friction.

- After various interactions with your business (i.e., support, etc.), such research would help you uncover how satisfied customers are with the level of your service.

There’s more, naturally. In fact, you could launch UX surveys pretty much after any completion of a task in the app (and once again, I argue that you should.)

The last thing we need to discuss is the tool to use…

How Refiner helps you collect and analyze user feedback

Refiner (disclaimer: this is my tool) is a complete customer feedback survey tool for SaaS & digital products. Refiner helps companies collect feedback & insights from their user base. It particularly focuses on tracking customer satisfaction metrics (NPS, CSAT, CES, etc.), as well as conducting user & product research.

Refiner’s flagship product, however, is what we call “in-product micro surveys”. These are short questionnaires that you can launch inside a web- or mobile application (iOS & Android) and capture contextual insights from a specific group of users as they are using an application.

As well as that, you can also use Refiner to send email surveys or distribute them with shareable survey links. These surveys can be used to capture feedback from users that are not currently using an application (abandoned purchases, canceled subscriptions, etc.)