Popup Surveys: Best Practices for Collecting Customer Insights with Surveys in Popups

This is the complete guide to popup surveys.

All the information I included here is based entirely on my personal experiences with running popup surveys AND building a running a popup survey tool.

I can promise you that with my advice, you’ll be able to use popup surveys effectively to collect customer feedback and gain incredibly valuable insights quickly.

Here’s what you’ll learn from this guide:

What is a Popup Survey?

When we talk about popup surveys (also referred to as on-site surveys, on-page surveys, or survey widgets), we typically mean a special form of customer feedback survey that appears on a webpage as a popup.

As a result, your customers can answer your survey without having to navigate elsewhere or interrupt whatever they’ve been doing on your site or app.

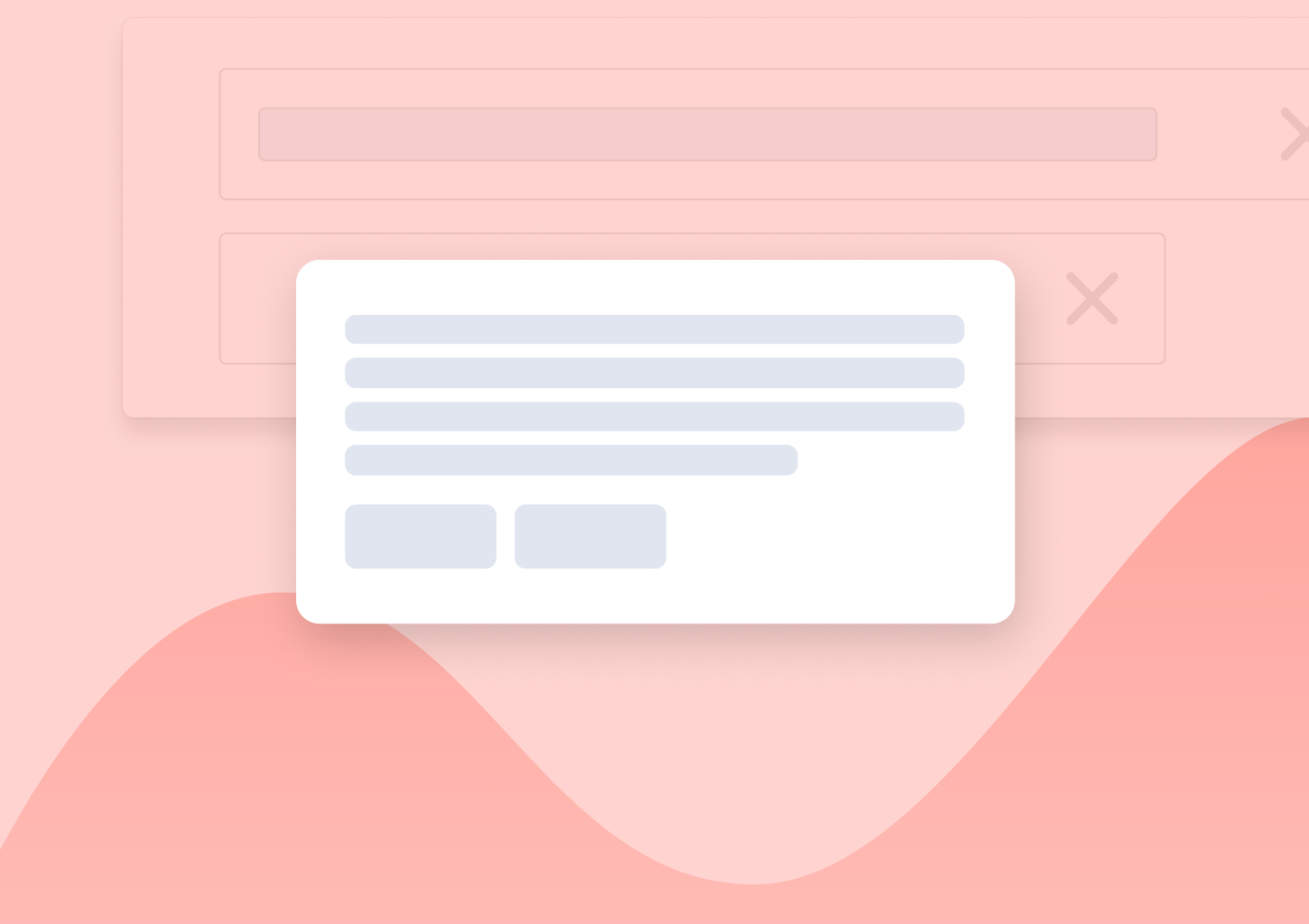

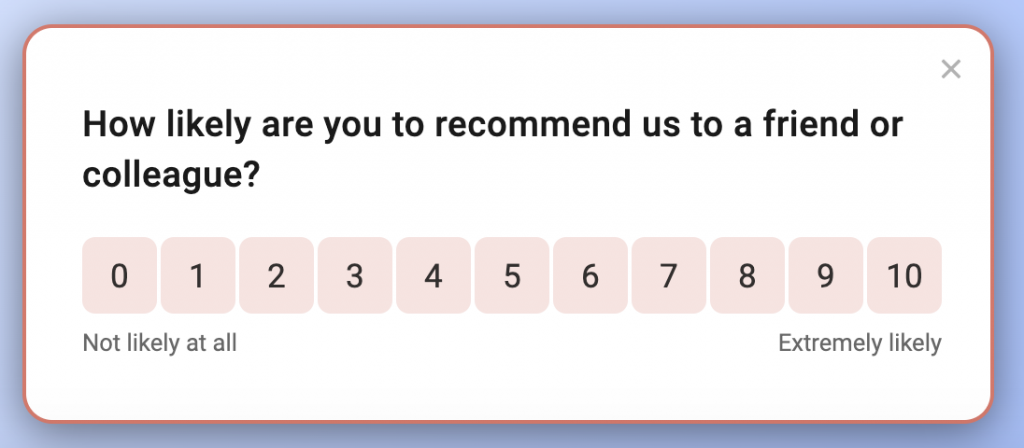

Here is one example of a popup survey.

Note it’s format – A small popup widget that appears somewhere on the screen, and asks a single question.

What’s more, the question itself uses a simple format, and requires little effort to answer.

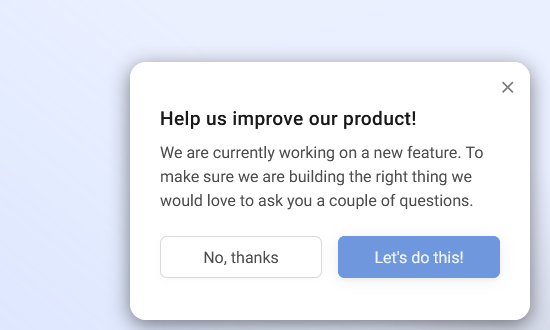

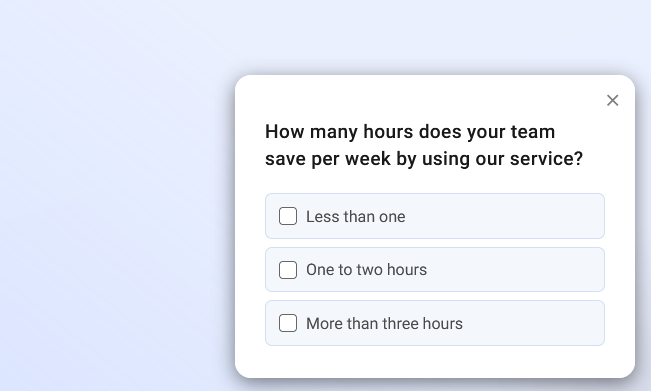

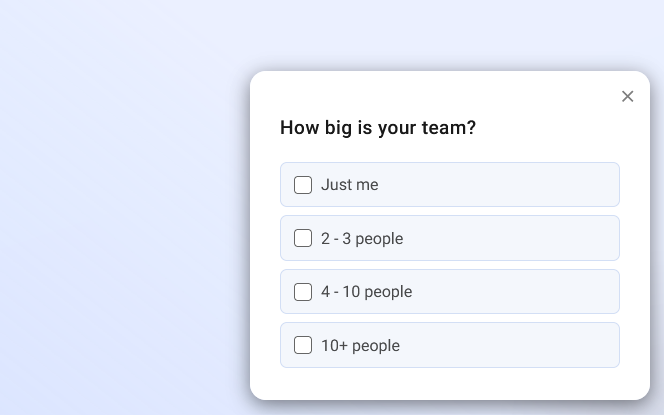

Here’s another example of a popup survey. Note how little effort is required from a person to answer it. All they need to do is select the appropriate option, that’s all.

Why Use Popup Surveys?

There are several reasons, actually.

First, popup surveys allow you to capture customer feedback in the context of their experience.

Popup surveys appear on the screen while customers browse your website or use your web application. As a result, these surveys allow you to collect their feedback on issues related to that experience.

Popup surveys are also ridiculously simple to set up, and require little to no maintenance.

In fact, once you’ve launched a popup survey, you pretty much don’t have to do anything with it (unless you need to edit its settings or so, of course.)

At the same time, popup surveys offer quite powerful options to manage when and where they appear.

For example, with popup surveys, you can segment respondents by page they’ve visited, actions they have performed on the site, the channel that brought them to the site, language, and more.

As a result, you can trigger different popups surveys to different visitors, ensuring that you collect exactly the insights you need from the people who have those insights.

By their nature popup surveys are also more difficult for visitors to ignore and generate far higher engagement.

Not to mention that popup surveys are usually short, too, composed of only one or two questions. This makes such popups quick and easy for customers to fill out, greatly increasing the response rates you generate.

6 Popup Surveys Examples

Here are a couple of examples of what companies use popup surveys for.

1/ Measure user satisfaction and identify weak spots in your product experience.

I suppose this is the most common use case for popup surveys by far. Companies trigger NPS, CSAT, or CES surveys within those popups and evaluate their customers’ satisfaction.

Not only using popups to run those surveys is easy but you also get to ask customers about their satisfaction exactly as they interact with your business or product. In other words, a double-win.

2/ Better plan and prioritize feature development.

For digital products, popup surveys offer an incredible opportunity to prioritize roadmap by collecting feedback from the very people who are actively using the product right now.

3/ Enrich your CRM with survey data and identify upsell opportunities.

4/ Qualify leads.

4 Best Practices for Using Popup Surveys

Let me tell you how to make your popup survey an absolute success:

#1. Have a clear goal in mind.

The popup survey can help you gain a whole range of insights. So, know exactly what you want to get out of the campaign before creating the popup. This way, you’ll be able to tailor the survey questions to your audience better.

#2. Time the popup properly.

Don’t just trigger the popup at the moment when someone lands on your site or logs into the app. Instead, figure out when your users are the most likely to be willing to answer the particular question you want to ask them, and set up the popup to display then.

In most cases, popup surveys appear a couple of seconds after a website was loaded. That said, there are other, often more effective ways to time the survey.

First of all, you can launch an exit intent popup. This survey will trigger when the website detects that a user is leaving the page. To do so, the popup relies on an exit intent technology that monitors the person’s cursor movements. When the system detects that a person has either moved the mouse cursor away from the browser window (to click the back button or type new URL into the URL box,) the survey pops on screen.

Another timing strategy is to target visitors who landed on a specific page. You can also trigger the survey when someone has spent a specific time on page. This strategy helps to target only the most engaged users – The people who have been reading the page’s content.

When used inside a web application, more sophisticated rules for displaying the survey are usually applied. For example, when a user connects to his account a certain number of times or when the user just performed a specific action.

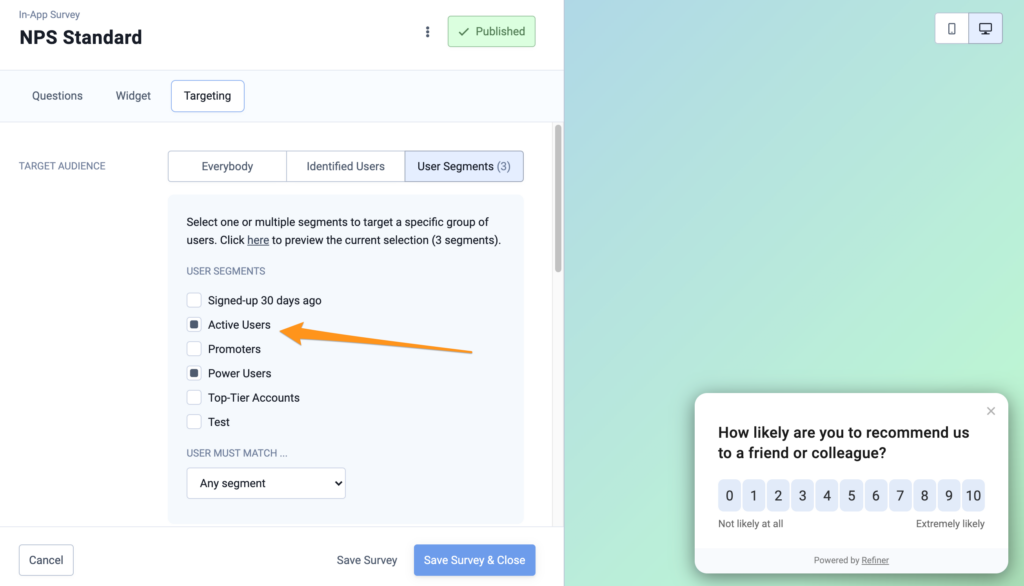

#3. Segment your audience

When it comes to website surveys, you can focus only on returning visitors or target visitors by the source of traffic, demographics and other characteristics.

#4. Test different placements

Usually, popup surveys reside at the bottom left or bottom right corner. Sometimes they are also displayed centered on a page in the form of a modal overlay.

Using these placements allows webmasters to attract visitors attention without disturbing the user experience on the site.

What Is the Average Response Rate to Expect

At Refiner, we usually see response rates of 3 – 5% for surveys shown to anonymous website traffic. Surveys which embedded in a web application shown to logged-in users yield response rates as high as as 60% – 70%.

The response rate of customer surveys depends highly on who you target and when a survey is launched. In other words, choosing a popup survey software which provides advanced trigger options is important.

Alternatives to Popup Surveys

Long Sign-Up Forms

There are a couple of issues with long forms on website.

Let’s take the case of creating an account for a website. Asking additional questions in your sign-up form will lower your conversion rates. Multiple studies show that shorter forms provide higher conversion rates.

Secondly, you probably won’t get accurate data. The reason for inaccurate data are multiple.

Users who decided to give your service of product a try most probably just want to dive in right away. If bothered with complicated questions, they might just enter bogus data to be done with sign-up procedure quickly.

And who can blame them?

At this point they don’t have a trust relationship with your brand and don’t have any incentive to provide accurate data.

Furthermore, they might actually not know the answer to some specific questions yet. Imagine you want to know which modules of your software a user plans to purchase. They likely can’t answer this question before testing and evaluating your product.

In other words: Some questions are better asked once the users settled in built up a trust relationship with your brand.

Enrichment APIs

Another approach for capturing customer data is to use data from enrichment providers like Clearbit.

Enriching user profiles with Third Party Enrichment APIs is a good alternative to forms – in theory. The data returned by enrichment services is however rather generic and unfortunately not that helpful most of the time. Assuming you have a hit and get back any data at all.

Don’t get us wrong, we are big fans of data enrichment services.

The idea is just magical. You provide an email address to them and they send you all kinds of demographic and firmographic data back in return.

The question is however how likely enrichment APIs return data that is actually useful and actionable for your business.

Let’s take the example of qualifying inbound leads.

Enrichment APIs usually return the size of a company which then is often used as an indication of likelihood that a lead becomes a high-value customers.

But does the fact that someone works at an enterprise scale company really means that they might become a big customer? Maybe the size of their team or their role within that team is actually a much better indicator.

You get the idea.

In our experience, it’s important to have the answers on very specific questions who are related to YOUR business and not generic firmographic data points.

Another issue with enrichment APIs are their match-rates. The match rate indicates how often an enrichment provider actually have data in stock for the query you are sending them. Based on the type of audience you are dealing with, match rates might be as low as 20% – 30%.

Chatbots

And what about Chatbots? Let’s face it. They provide a rather noisy user experience and have very low response rates.

It’s hard to say why exactly they provide such low response rates. Our best guess is Chatbots are mainly perceived – as their name suggests – a way to start a conversation.

But you don’t want to start a conversation with your users. What you want instead is capture specific data points.

In other words, Chatbots are not the right tool to capture user data in our opinion.

Let’s look at another way of capturing data from your users: In-App survey widgets like the ones provided by Refiner.

Advantages of Using Pop Up Surveys

So how do customer survey widgets hold up to all the options listed above?

As you’ll see below, pretty good!

Let’s see how they compare to the three alternative options mentioned above:

| Long Sign-up Forms | Chatbots | Enrichment APIs | Pop-up Surveys | |

| Ask any question | Yes | Yes | No | Yes |

| Response / Completion Rates | Medium | Low | Medium | High |

| Data Accuracy | Medium | Medium | Medium | High |

| Profile Users Gradually | No | Yes | n/a | Yes |

| Unobtrusive UX | No | Yes | Yes | Yes |

| Context Sensitive | No | Yes | n/a | Yes |

Let’s look at some of the aspects more in detail:

Advantage #1: High response rates

As mentioned above, popup surveys have great response rates compared to alternative data capture methods.

Advantage #2: Accurate data

As mentioned above, asking specific questions at the wrong time – e.g. during the sign-up process – will leave you with inaccurate data. On the other hand, asking your users simple questions while they are using your product will deliver highly accurate responses.

Why is that? It all boils down to whether or not a user trusts your brand and sees an incentive in answering a survey truthfully.

The moment they are using your product and getting value out of it is such a moment.

Advantage #3: Great User Experience

A common misconception is that embeddable surveys have a clunky feel to them. It’s not true though. It all depends on the survey tool you are using.

Refiner provides on-page surveys with a minimal and brandable design. The results are snappy surveys that integrate perfectly in your app or website.

Furthermore, you can target your users with micro-surveys consisting of only one or two questions. Delivered to the right users at the right time, allows you to gradually profile your users in an unobtrusive way.

Advantage #4: Ask any question

In-app surveys allow you to ask your users any question while they are using your product. You can even ask rather complicated question if you target the right audience and ask the question at the right time – for example right after a purchase.

The user surveys of Refiner allow you to ask single choice, multiple choice and open ended questions. Furthermore, it allows you to ask typical customer satisfaction metrics like the Net Promoter Score (NPS), Customer Satisfaction Score (CSAT) or Customer Effort Score (CES).

The list goes on!

Looking at this list above it becomes obvious that capturing customer data with Popup Surveys represents a huge lever for SaaS companies.

Want to give it a try? Create a free account with Refiner and get your popup survey widget installed on your website in minutes.