This is How You Run a Perfect Customer Survey for a Digital Product

So, here is what I know about your situation:

- You already know how helpful customer surveys are for building and growing a product.

- You also know the amazing insights you gain by collecting and analyzing customer feedback.

- Not to mention the benefits you get from involving customers in the product discovery process.

Because of that, I’m not even going to bother with trying to convince you to run customer surveys.

You already know that you have to.

What you may not know, though, is how to run customer surveys that people want to respond to and share their insights with you, right?

Well, keep on reading to change that.

What we’ll cover:

- What exactly are customer surveys (and what they are not.)

- When to use them (and when other types of surveys work better.)

- How to create surveys that customers want to respond to, and more.

It’s a lot to cover so let’s get right to it.

What are customer surveys?

The term – customer surveys – is pretty self-explanatory, isn’t it? It refers to a strategy of soliciting customer feedback through surveys.

But … there is a tiny bit more to that, actually.

First of all, when we speak of customer surveys, we don’t talk about just any survey you send to customers. Sure, it might seem so based on the term, but that’s not the case.

Typically, customer surveys refer to the feedback we collect from customers to evaluate specific information:

- Uncover customer satisfaction and engagement levels (and we have very specific survey types for that – NPS, CSAT, etc. You’ll learn more about those in just a moment.)

- Evaluate their expectations and challenges when using our products, and so on.

We can also use customer surveys to learn more about the people who use our products or services, discover their demographic characteristics, profile customers, and more.

But in general, think of customer surveys as your gateway to uncovering what customers think about your product and how well it delivers on their expectations.

Most popular types of customer surveys

We’ve touched on this briefly above, but I believe the topic warrants a deeper exploration, and so, here it is.

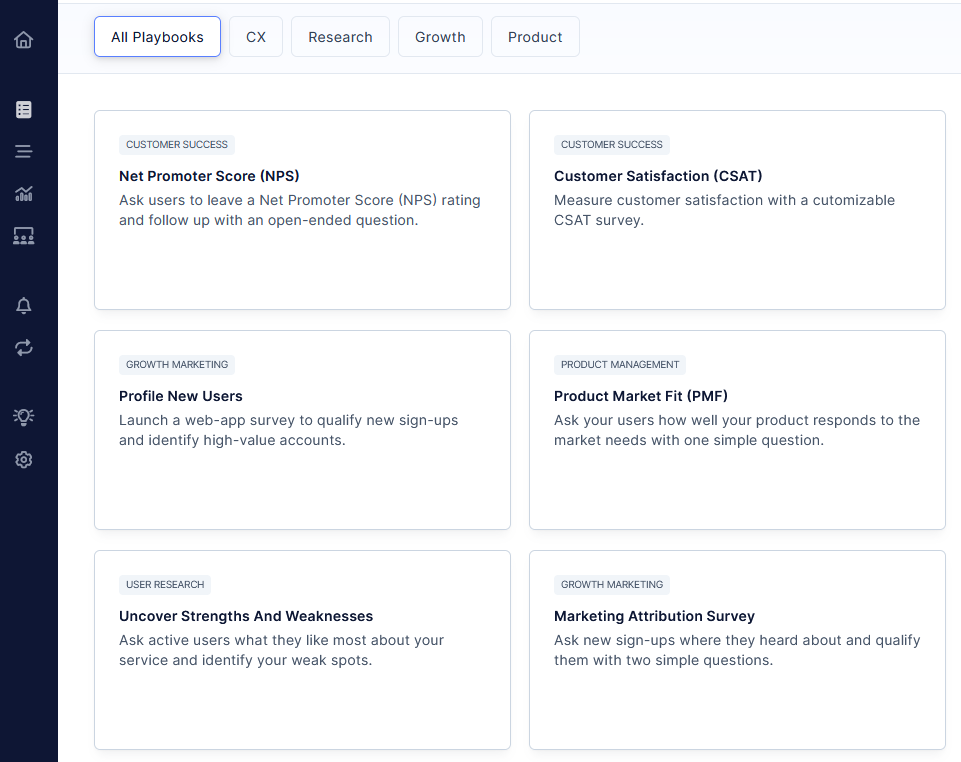

Typically, companies launch several different types of customer surveys:

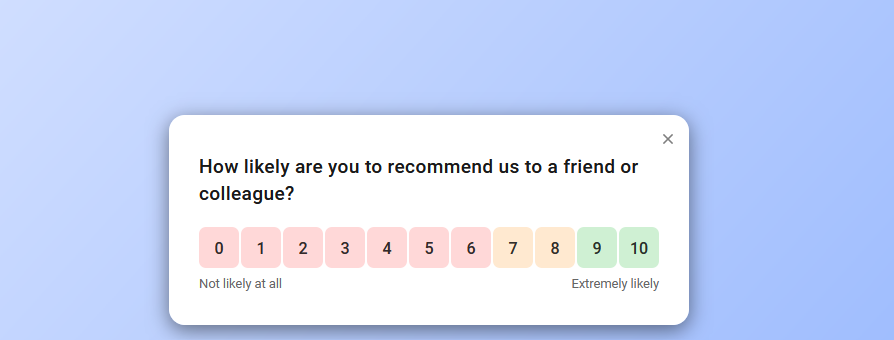

- NPS (Net Promoter Score) surveys that help measure customer satisfaction and loyalty.

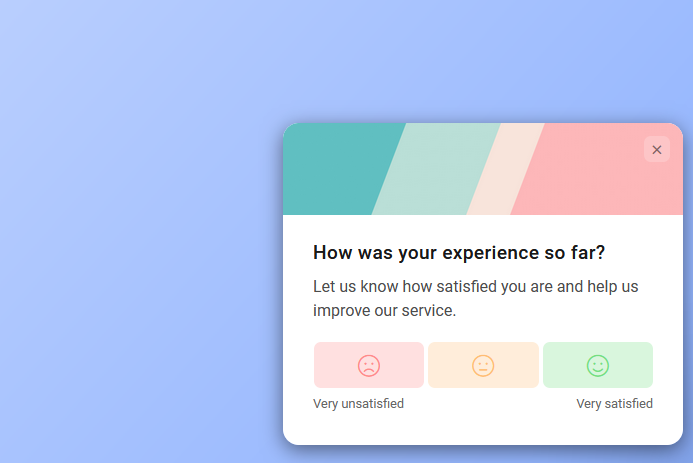

- CSAT (customer satisfaction) surveys deliver insights about how satisfied customers are with a product or service.

- Product surveys that help uncover what your customers would like you to build next

- UX research surveys that collect qualitative and quantitative insights from your existing customers about your products or services

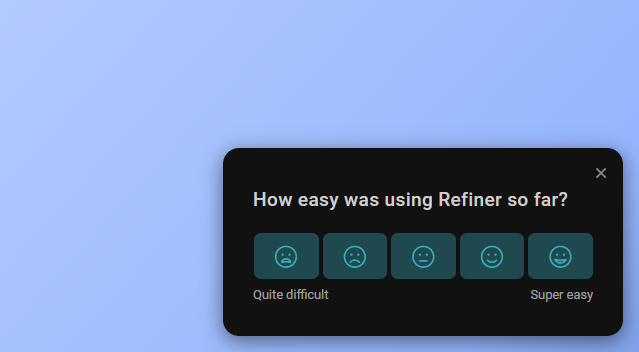

- Customer effort score (CES) surveys that measure the ease of experience with a brand.

- Post-purchase surveys that evaluate customer sentiment after an interaction with a brand (i.e., a purchase but also engagement with sales, customer service, etc.)

- Usability surveys, and more.

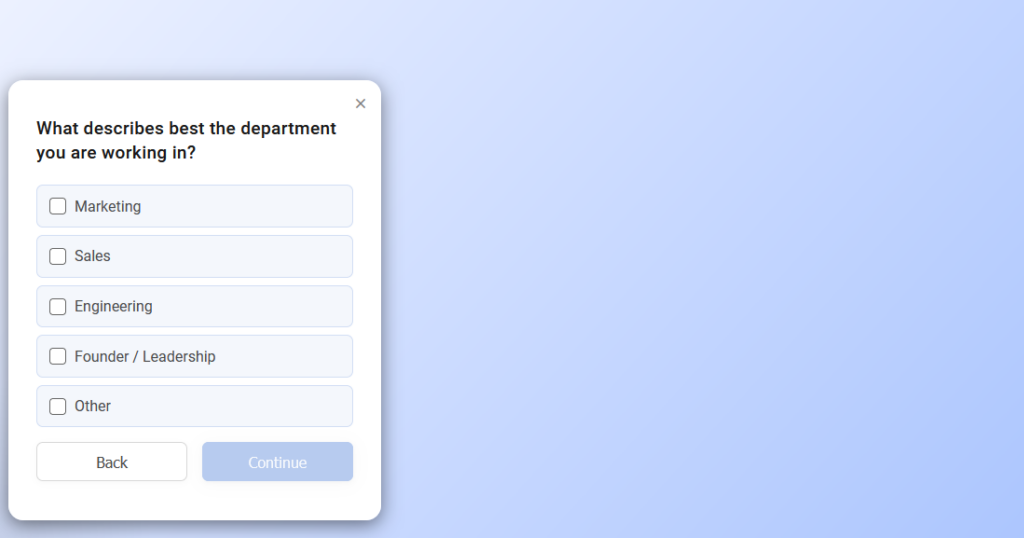

Here are a couple of examples of these customer surveys.

Net promoter score

This is an ideal customer survey to use when you want to find out how indispensable your product is to users.

Note – In this guide, you can learn more about running NPS surveys.

CSAT score

A customer survey helps you evaluate whether customers are satisfied with your product or its specific functionality.

Learn more about running CSAT surveys from this guide.

CES survey

CES survey lets you uncover whether customers find your product challenging or effortless to use.

Learn the core differences between CES, NPS, and CSAT surveys.

Roadmap validation survey

This customer survey type, on the other hand, lets you gauge your users’ interests and identify which product capabilities to focus on in the future.

Learn more about using surveys in product discovery.

How to Launch (and Run) Successful Customer Surveys

We’ve covered what customer surveys are. You also know why you absolutely must run them and what survey types to use when collecting customer feedback.

What’s left for us to discuss is how to do it, exactly. And below, I’ve outlined some of the best practices for running customer surveys in general, as well as ideas for various specific survey types (i.e., NPS, etc.)

Overall, the process of launching and running a survey includes several phases:

- Defining the goal for the survey to know what survey type to launch

- Identifying target audience

- Deciding on the delivery channel

- Writing survey questions, an activity that’s often the most problematic part of the process

- Building survey logic, although that step isn’t necessary for all survey types

- Setting up survey timing and frequency

- Collecting the data and either analyzing it or sending it to other tools for processing

Let’s look at all those steps in detail.

Step 1. Defining survey goals

The challenge with running customer surveys is that there are so many different types and survey objectives that you could aim for.

NPS or CSAT helps evaluate customer satisfaction. You use product market fit or roadmap validation surveys to uncover what customers think about your product, and so on.

Then, there’s the fact that you can run almost any customer survey to evaluate your brand or product in general or focus on a specific aspect of your business

All this means that for any survey, you have several (or more) different variations to choose from.

The only way to know which one to use for sure is to begin the project by defining what you want to get out of the survey.

Few things to remember here:

- Be specific. This probably sounds cliche, but it’s true. Don’t focus on more than a single metric that you want to evaluate. And needless to say, the more specific you are about it, the easier it will be to select the right survey type.

- Tie your goal to a specific business outcome or objective that you’re working towards. Again, sounds obvious, but you wouldn’t believe how many startups I see making this very mistake – Evaluating metrics that are “hot” among their peers rather than focusing on what they want to achieve in their businesses.

- Match the goal to a specific survey type. For example, if you’re planning to evaluate customer satisfaction, set up a CSAT survey. If you’re trying to find out whether you’re on the right track with meeting the market demand, focus on a product market fit survey.

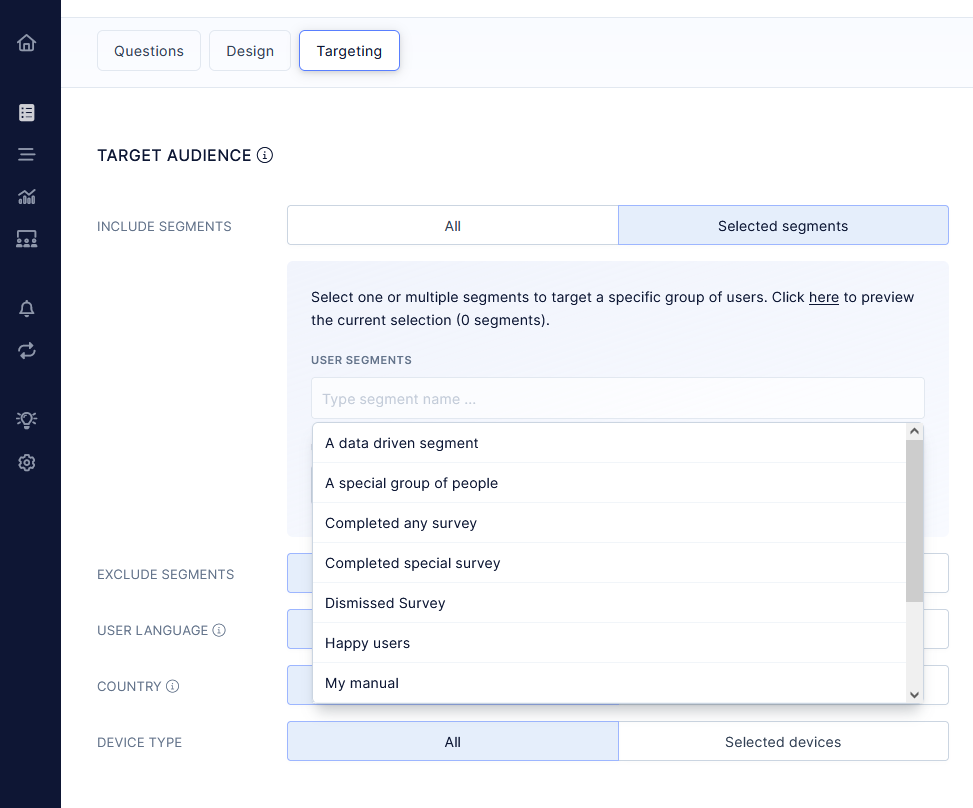

Step 2. Identify the target audience

Please note – In this context, when I talk about the target audience, I mean the recipients of your survey. It’s obvious that these would be your existing customers, but, and this is where it gets important, depending on your survey, you might not be collecting feedback from all of them.

Some research projects will require you to segment the audience. Perhaps you’ll want to evaluate what your longest-running customers think about your product. Or discover how new customers perceive your signup process, and so on. And needless to say, each of these audiences will require a different survey, different survey questions, and so on.

So, as the next step, clearly define which of the audience segments is best suited to deliver the insights you seek.

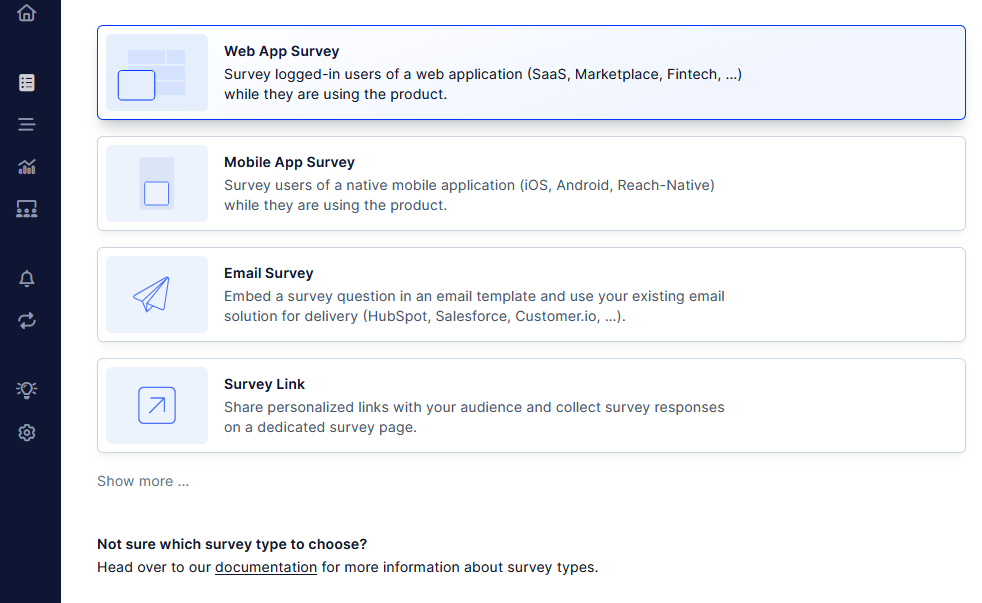

Step 3. Decide on the delivery channel

The key to running a successful survey is positioning it in front of your desired audience segment when these people are the most likely to respond. In practice, this means using a delivery method that’s the most relevant to them.

This could be:

- Embedding a survey into an email template and using your existing email marketing platform to deliver it to customers.

- Triggering the survey in your web app directly. Whenever a user within your target segment logs into the app, they’ll see (and be able to respond) to the survey.

- Doing the same but for mobile app users.

- Or sharing a link to the survey with your audience.

Step 4. Writing survey questions

Earlier on, I named this step an activity that’s often the most problematic part of the process, and I did it for a reason.

You see – Questions can make or break your survey. Ask the wrong question, and you’ll collect irrelevant insights. Phrase the question wrong, and customers won’t know how to reply and will, most likely, avoid completing the survey.

The same goes for using the wrong question type. Ask an open-ended question instead of a multiple-choice one, or vice versa, and you’ll, most likely, only confuse your audience.

Now, writing survey questions is a topic of its own, far too exceeding this guide’s content. That said, I wrote several guides that focus specifically on different types of questions to include in customer surveys. Use them to learn how to write the best questions for:

- User experience surveys

- Customer feedback surveys

- Customer effort score surveys

- CSAT questions

- Product surveys

- NPS surveys

- Transactional NPS

- Customer satisfaction survey questions

(TIP – Refiner features a whole range of question templates (like CSAT template, for example) that let you start collecting customer feedback right away.)

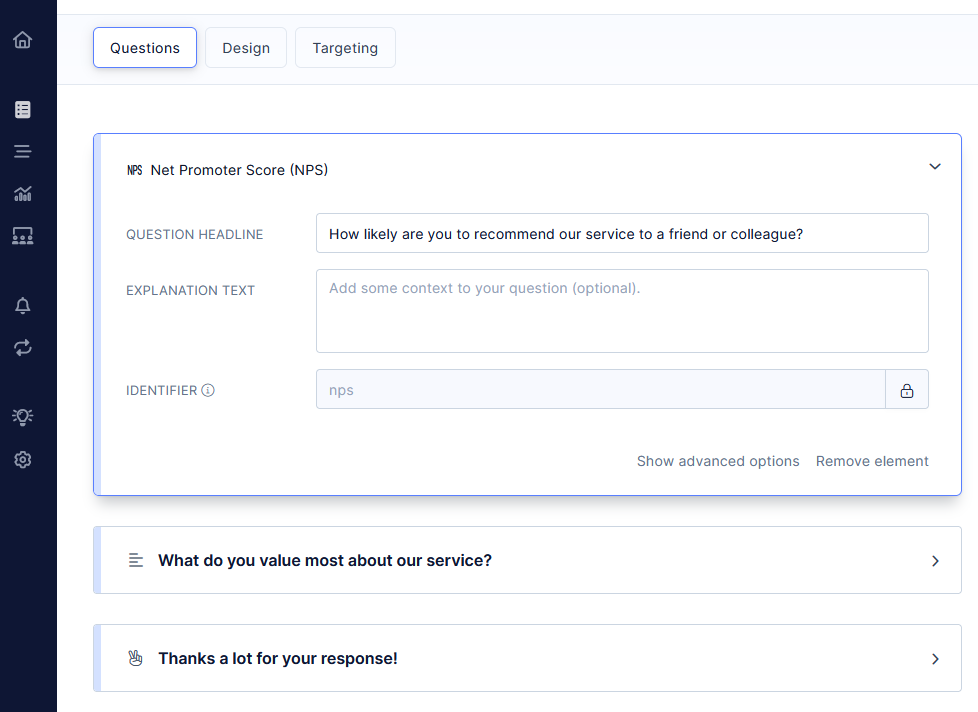

Step 5. Survey logic (optional)

Let’s face it – Survey logic isn’t something you need to use in every research project. But it does come in handy sometimes.

Let me explain.

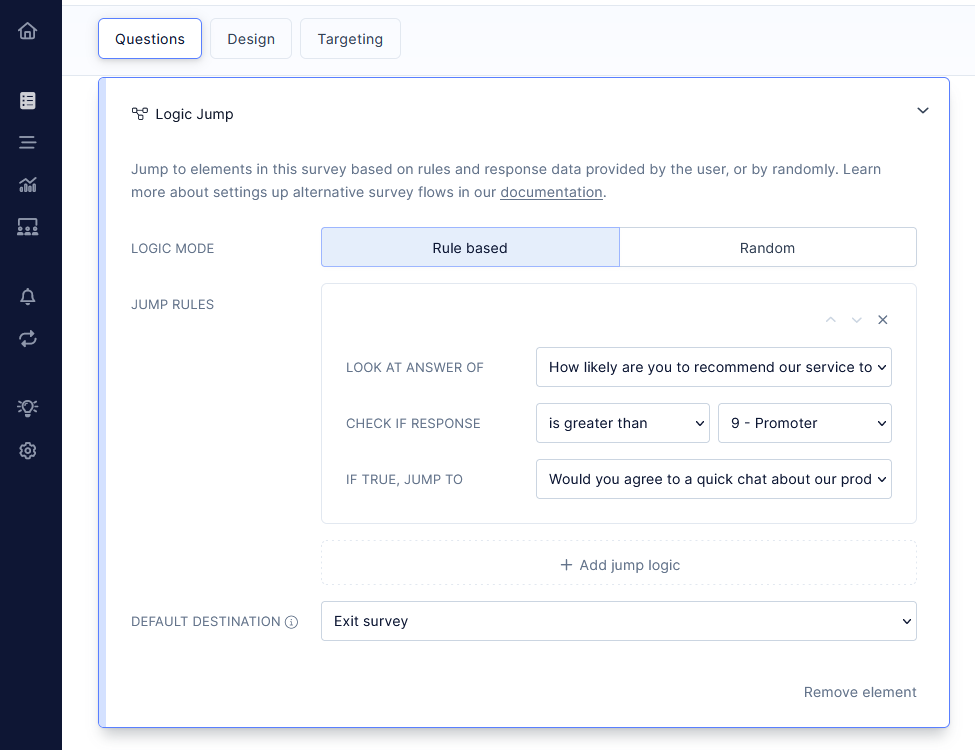

Survey logic is a capability within a survey platform that allows you to display follow-up questions based on the person’s initial response. For example, you could set an NPS survey to display different follow-up questions depending on whether the person scored your product as a promoter or detractor.

If they scored you as a promoter, you might ask whether they’d agree to a quick chat to learn more about their experience. But if the person rated themselves as a detractor, then you might ask them to tell you more about what you could have done differently.

Here’s an example of how such a scenario would look like in Refiner.

Survey logic lets you ensure that customers will only see those questions that are relevant to them and, thus, provide you with the most relevant insights.

But, as I said, it’s not something that’s absolutely required to run a successful customer survey.

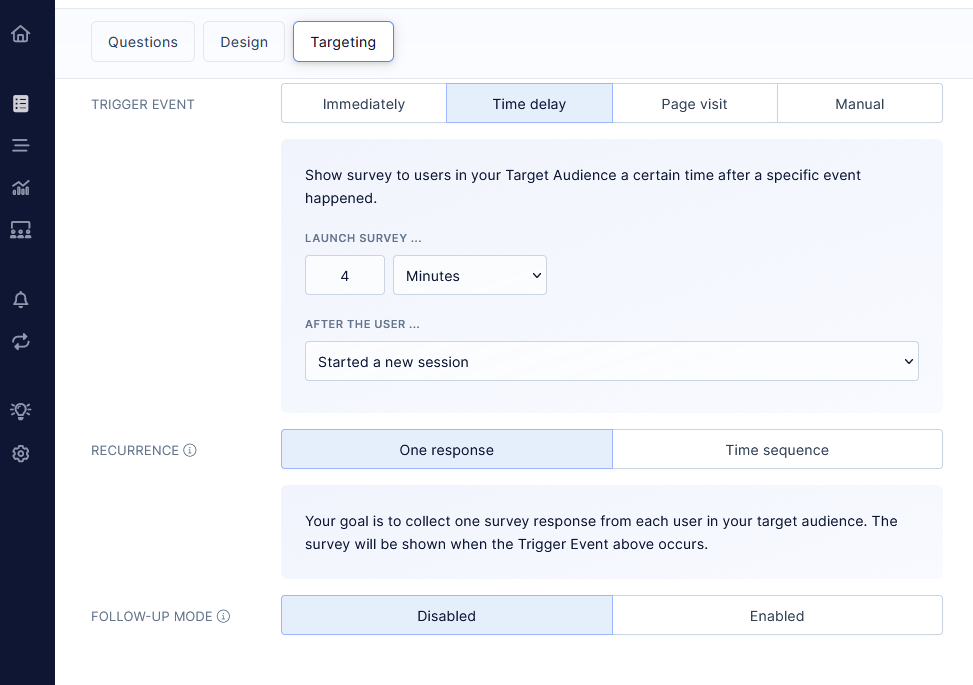

Step 6. Specifying survey timing and frequency

For most customer survey projects, this is the final step before going live. And it’s one you should never overlook.

Just like a poor question can deter a person from completing your survey, displaying it at the wrong time will have an almost identical effect.

As I wrote in my guide to NPS frequency and timing:

“The success of any survey largely depends on timing. Send the survey at the wrong time, and you might be facing ridiculously low open rates. Well, that and poor quality data such poorly timed surveys might deliver, of course. But do the opposite – send it when your customers are the most engaged with your brand or product – and you’ll collect absolutely incredible feedback that will help you drive the business forward.”

But how do you know when to trigger the survey?

The actual timing depends on several factors:

- The type of survey you run,

- The target audience, and a few other factors.

Once again, much of this greatly exceeds the scope of this guide. That said, I wrote two specific guides to customer survey timing, and I recommend that you run them to learn everything about when’s the best time to run your surveys:

(Different launch triggers for a web-based survey in Refiner.)

And that’s it…

This is everything you need to know to get started with collecting customer feedback with surveys.

All that’s left is to create your first customer survey and begin collecting customer insights.

Good luck!