Product-market Fit Metrics: How Do You Really Measure PMF?

There are three things every startup founder learns first:

One is to know why they’re launching the business (and what will await them when they do)

The second is to learn as much as possible about the target audience and be prepared to pivot.

And finally, they are told that they need to find their product-market fit.

None of this advice is bad, by the way. It’s all 100% on point, in fact. But from talking to startups signing up for Refiner, I know that to many, the last part, the concept of measuring product-market fit, seems as elusive as time travel.

Well, hence this guide. Below, I’ve outlined some ways to measure product-market fit, and the metrics to use to determine whether you’ve reached it or not.

Before we get to that, let’s cover some basics, shall we?

What exactly is product-market fit?

Well, when we talk about a company that has achieved the product-market fit, we really mean that they’ve built something that is meeting the needs and demands of their target market.

Or to put it in simpler terms – their product has finally reached a point where it delivers what customers want.

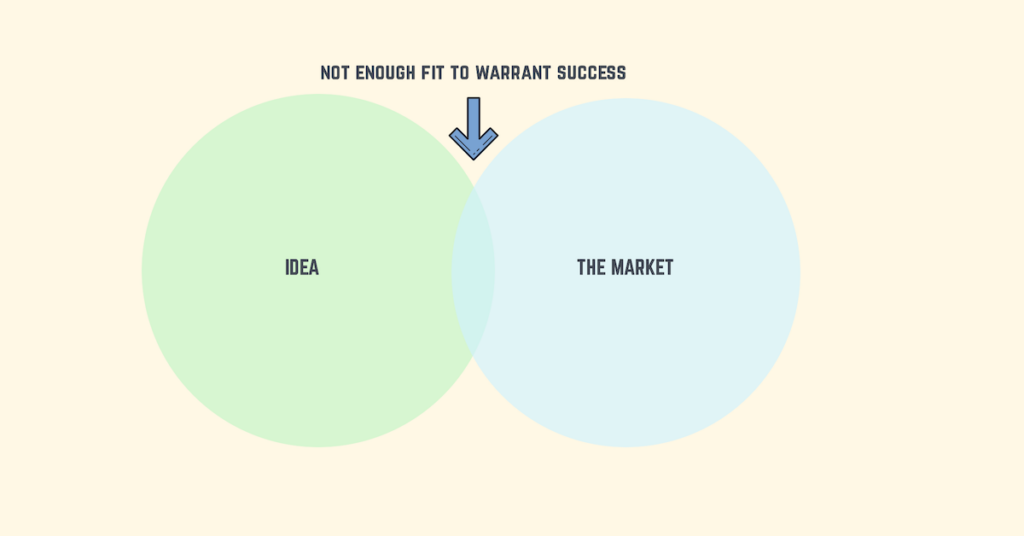

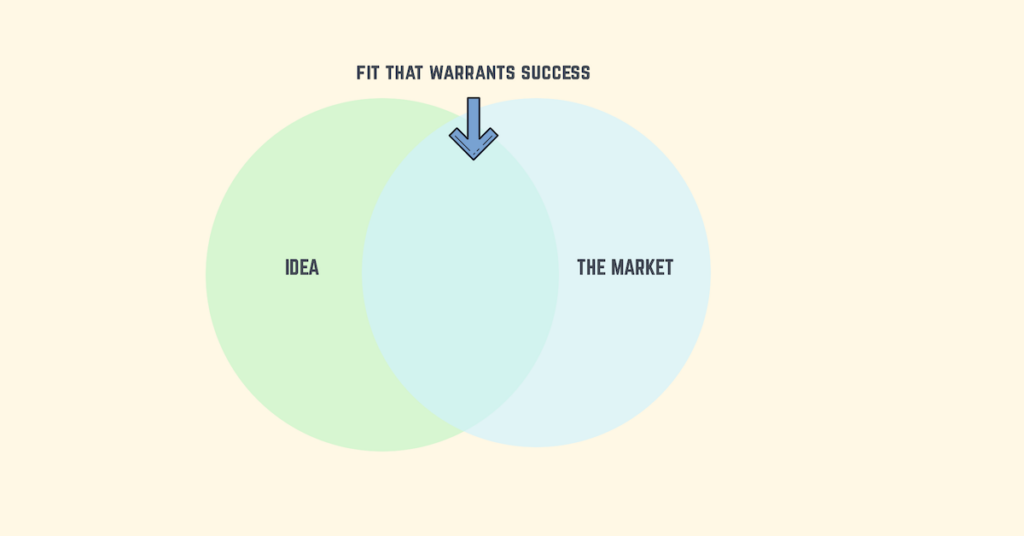

In an earlier post, I showed the difference between having the product-market fit and not having one with two diagrams. I’ve included them below, but I also recommend that you go and review that other guide.

In general, companies without product-market fit to operate on a very slim intersection of their product and the target market. Needless to say, in most cases, such a tiny intersection isn’t enough to warrant any success at all.

Companies that have achieved the product-market fit, however, enjoy a much greater alignment between what they offer and what the market wants.

Like this.

In this case, the intersection is big enough to warrant a large potential market and guarantee potential of success.

And this basically answers why startups focus on reaching the product-market fit so much. Achieving it is the first signal that they stand a chance to grow and profit.

(By the way, I deliberately said, stand a chance. There is obviously much more involved in growing a startup, but none of this would be possible without the product-market fit.)

That covers the what and why of product-market fit.

Let’s look at the how, then.

So, how do you measure product-market fit and figure out where you are with it?

First things first, there is one “official” (I don’t like this term, by the way, but that’s what it is, so I’m using it here too) way to determine product-market fit, and several additional metrics that can hint at where you are with it.

I’m going to go through them in that order.

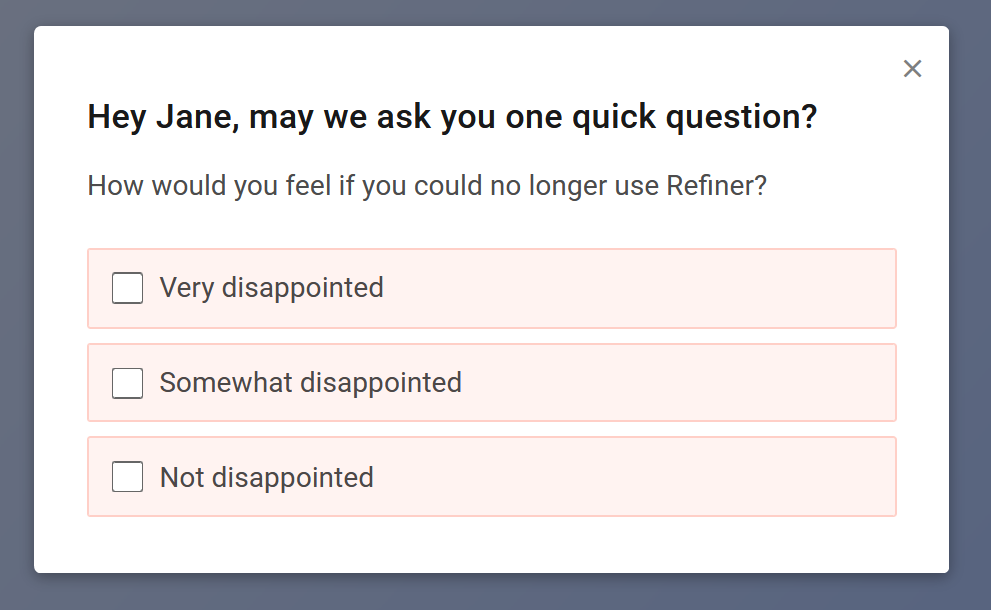

So, the “official” way is the Sean Ellis survey.

It looks like this.

The survey asks just one question and aims to uncover just one single thing:

How many of your customers would be very disappointed if they couldn’t use your product anymore?

As you may have guessed, the greater that segment, the more likely it is that you’ve achieved a product-market fit.

Before I tell you what the magic number of those disappointed customers should be, let’s review some logic behind the survey.

Product-market fit defines the alignment between a product and the market demand. So, having a significant customer segment responding “very disappointed” to the questions suggests that:

- Your product meets the market demand. That part is obvious, but there’s more.

- The audience seems to see your product as a solution to their problem.

- Finally, your product attracts customers with that very problem, and they resolve that problem with it successfully.

And needless to say, achieving it all is no small feat so let me give you some pointers to success:

First things first, to measure product market fit, you need to collect customer feedback. There really is no other way. You need to present the product-market fit question to your users and evaluate their responses.

And there is no better way to do that than by running product market fit surveys inside your product.

In-app surveys are highly flexible, for one. You can trigger the survey popup or widget at a specific moment when the person’s using your product.

You can also tailor surveys to specific user segments or display them to a particular segment only.

Finally, you have the option to design the survey to collect the most relevant information.

- You can use multiple-choice questions like what I’ve included in the example above.

- But you can also follow that up with an open-ended question that would allow a customer to provide more insights into their primary answer.

So, what about the magic number? What score would suggest that your product has achieved a product-market fit?

The answer is 40%.

By the way, I’m serious here; the number’s nothing to do with the ultimate question of life, the universe, and everything. Really.

(And to be precise, the answer to that question was 42…but I digress.)

In his research, Sean Ellis discovered that startups that achieved a minimum of 40% score in the survey fared much better on the market than those with lower scores.

Two other ways to measure and determine the product-market fit

The survey I introduced above is by far the standard for measuring product-market fit. But it’s not the only way to do it.

In fact, many of our customers at Refiner are using PMF surveys in combination with other surveys. One example we wrote about is Thriday. They are successfully combining PMF, CES and other survey types.

So, here are some additional surveys and research methods to help you determine where you are with achieving the product-market fit.

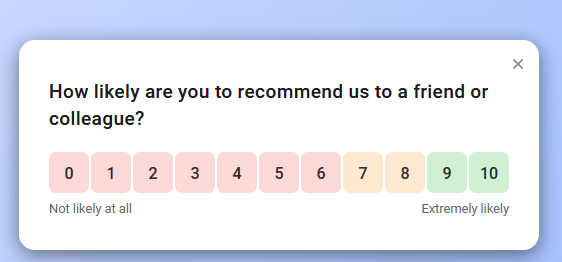

#1. Net promoter score

Net promoter score (NPS for short) is a globally recognized customer satisfaction and loyalty metric.

At the core of NPS is another single-question survey that looks like this:

NPS was developed by Bain and Co in 2003, and the metric has become a staple for anyone wishing to understand better how customers perceive their products and services.

The goal of NPS is to evaluate how many customers you have in these three groups:

- Promoters are customers who rated their likelihood of recommending the company or its products with a score of 9 or 10. These are loyal customers, enthusiastic about your product. Most likely can’t imagine living without it.

- Passives who are certainly satisfied customers but not happy enough not to be swayed by competitive offers should those arise.

- Detractors or unhappy customers. These people not only do not enjoy using your products but also are open to voicing their dissatisfaction.

This brings us to product-market fit…

Sean Ellis’ survey measured where you are with it based on the person’s attitude towards the product. And as it turns out, NPS works in quite a similar way. By evaluating the likelihood of a person recommending your product, you can determine how satisfied they are with it.

And just like with the other survey, the more promoters you have, the greater the likelihood that your product is matching the customer needs and market demand.

#2. Cohort retention rate

Technically, the cohort retention rate is a metric a business can use to understand its relationship with customers better. But as you can imagine, part of that relationship revolves around delivering on the customer’s needs and the market demand … or a product-market fit, basically.

So, what’s the cohort retention rate? In the simplest terms, this metric analyzes the percentage of customers who continue using your product over time.

Some startup founders suggest measuring the cohort retention rate against the percentage of customers who continue using the product a certain number of weeks after onboarding, and I find this a particularly good idea.

Because let’s face it; if a customer continues to log in and use your product months after signing up, then it’s almost impossible that they don’t get value from it (and thus, we can assume that the product meets their demand.)

And that’s it

That’s how you measure and determine the product-market fit, and the metrics you use to do so.

All that’s left for you to do is choose a method and start implementing it in your startup.

Good luck!