How to Use UX Research Surveys for Product Development

As a technical founder, I couldn’t deny it even if I tried – I love building my product. And I do mean every aspect of the process here, including figuring out what to build.

But I also know that to other founders, the process of identifying users’ needs is pretty challenging. It’s often difficult to even imagine where to begin. Or what strategies to use to collect that feedback, right?

The good news is that the process is easy (and relatively quick to do, too), but it involves running UX research surveys.

Here, let me show you.

What exactly do I mean by a UX research survey?

I love this quote from Erika Hall (I’m quoting it after Userinterviews), who said:

“Surveys are the most dangerous research method.”

Oh, they are.

Granted, surveys can deliver incredible insights into your audience’s preferences, needs, challenges, issues, and so on.

But it’s also so easy to misinterpret that feedback. It’s difficult to avoid bias too. Not to mention that it can be quite tempting to use those insights selectively to prove your point (rather than extract objective insights.)

And nowhere else can it become more evident than in UX research surveys.

So, the term – UX research survey – refers to a user research method that you employ to collect qualitative and quantitative insights from your existing customers about your products or services.

As the name suggests, the method is survey-based, meaning that, to provide feedback, customers need to answer your questions.

Now, the word, questions, can be misleading in this context, so let’s stop briefly and discuss this.

Most of the time, we associate the word, questions, with having to provide some lengthy reply or explain our emotions or impressions. But that’s not always the case with UX survey questions, actually.

Granted, you might ask users to provide more information about the context of the customer’s impressions, motivations, etc. But often, in UX research surveys, your leading questions should focus on collecting quantitative insights. And you do that by asking closed-ended questions.

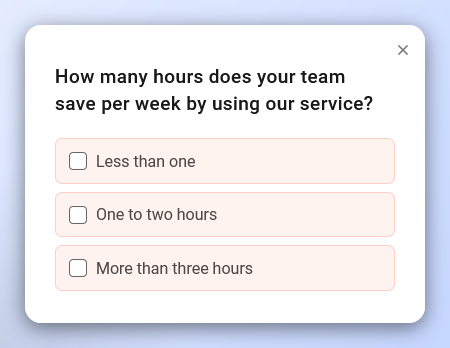

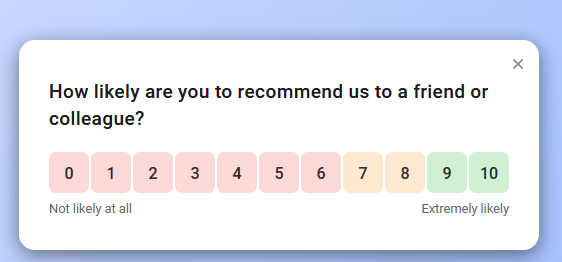

Here’s a quick example of a UX research survey aiming to gauge perceived product value.

Note that the only thing a customer needs to do to complete it is to select the appropriate response.

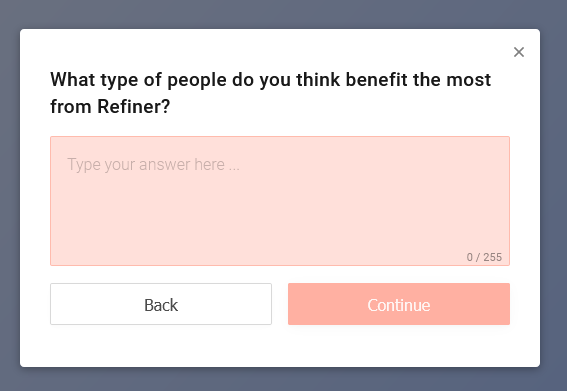

That said, you can also include a follow-up question in your survey. This time, however, you could use an open-ended question to help you learn more about the reasons behind the person’s original answer and reveal their thoughts about the problem.

Here is an example of a follow-up question to a product-market fit survey.

Let’s circle back to UX surveys, though.

How exactly do you use UX research surveys for product development?

We’ve covered the two types of UX survey questions – closed and open-ended ones. But I think it’d be a good idea also to see what type of insights you should seek to drive product development.

And so, typically, we run UX research surveys to:

Validate concepts or feature ideas

In this option, you aim to collect existing customers’ ideas about new features or capabilities that you’re considering introducing to the product.

I like to think of this research as a way to validate my own ideas. It’s as if you were taking your dream product and running it by users to see what they think.

Because let’s face it, what we, founders, want to build doesn’t always match what the audience needs.

UX research surveys are a great way to get a real-world perspective on our ideas and see which ones resonate with our customers the most.

When to run these UX surveys? Ideally, early on in any stage of the product development cycle.

Collect product feedback

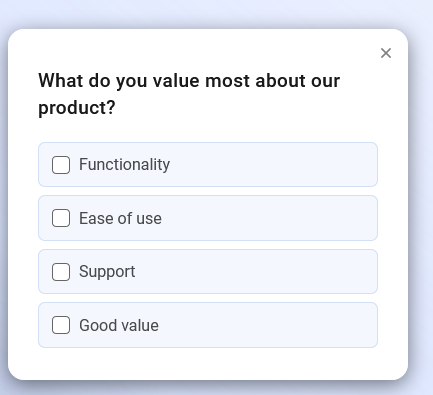

These questions help you understand what aspects of your product are most important to your audience and whether you’re focusing on improving the right features moving forward.

UX surveys focusing on product feedback help you understand:

- What features do users tend to use the most,

- Their impressions about those features,

- What they constantly struggle to find (or understand) in your product,

- Where do they go first after logging in to the app,

- What are their usage patterns,

- What actions do they perform over and over, and which ones do they almost never do, and so on?

Here are some example questions to ask in a product feedback UX survey:

- How often do you use the product?

- Which feature do you use the most?

- What are the essential features that our product is missing?

- How easy is it to use [feature or capability]?

Evaluate customer satisfaction

These surveys help you uncover whether customers are happy with your product. They also reveal what might be the reason for any dissatisfaction (and what makes customers raving about you to others.)

Overall, you can use several different methods to evaluate customer satisfaction.

- Net Promoter Score (NPS)

- Customer Satisfaction Score (CSAT)

- Customer Effort Score (CES), etc.

I’ve written extensively about each of them already. Here are some guides to help you learn when and how to run UX surveys to collect data about customer satisfaction:

- What is NPS

- What is CSAT Survey

- What is CES

- Differences between NPS, CSAT, and CES

- How to measure customer satisfaction

Pros and cons of running UX research surveys

We’ve discussed what and how in UX surveys. But there is also the question of why, and also why not run them.

Let’s talk about that, then.

UX research surveys – the pros

- Scalability. You can run these surveys regularly (in fact, I encourage our customers to do so and run ongoing UX research.) You can easily run those surveys on different user segments, ask different questions, and collect all types of insights without having to worry about accruing more costs.

- Low cost. UX research surveys are inexpensive to run. We’ll be discussing software to run them shortly, and you’ll see that the cost of running surveys isn’t high.

- Amazing insights. UX research surveys deliver data that makes you and your product team more confident about your direction.

- No Hawthorne effect. The term – Hawthorne effect – relates to a situation where participants modify their answers in response to their awareness of being observed. And it’s something that often occurs in research methods like focus groups or interviews. But surveys are free of that, meaning that whatever feedback someone shares with you is not biased or affected by any external factors.

- UX research surveys deliver statistically relevant data too.

What about the cons, then?

Unfortunately, these surveys have some limitations too.

- Potential for sampling bias. In some cases, your surveys might deliver disproportionately higher numbers of positive or negative responses. This is typically tied in with a perceived gratification for participation.

- Qualitative data isn’t always high quality. This is one reason why researchers prefer to use a quantitative approach to leading questions and focus on qualitative data in the follow-up only.

- It’s easy to create bad surveys. Or deliberately design them to prove your point rather than collect objective data.

How to launch your first UX research survey

The last thing I want to show you before I talk about the survey software to use is the process of creating a UX research survey. Because even though it might seem so at first, there is more to it than just creating a survey.

(Although that is a big part of it, of course.)

And so, in general, the process includes the following elements:

Setting up goals for your research. In other words, before you build the survey, you must decide what you want to discover. The decision – your goal – will affect almost every aspect of the survey:

- The survey format

- Customer segment that you’ll be targeting

- The leading question and the follow-up question

- Integrations to route insights too, and more.

FURTHER READING: Learn everything about designing product surveys.

Defining questions. Naturally, these are based on your goals, and help deliver insights to help you achieve your goals. So, for example, if your goal is to evaluate customer satisfaction, then, most likely, you’re going to use NPS or CSAT questions. If, on the other hand, you’re focusing on testing new ideas, you’ll be more likely to ask product questions.

FURTHER READING:

- Best product survey questions to ask

- Best NPS questions

- Best CSAT questions

- Best CES questions

- Best customer satisfaction survey questions

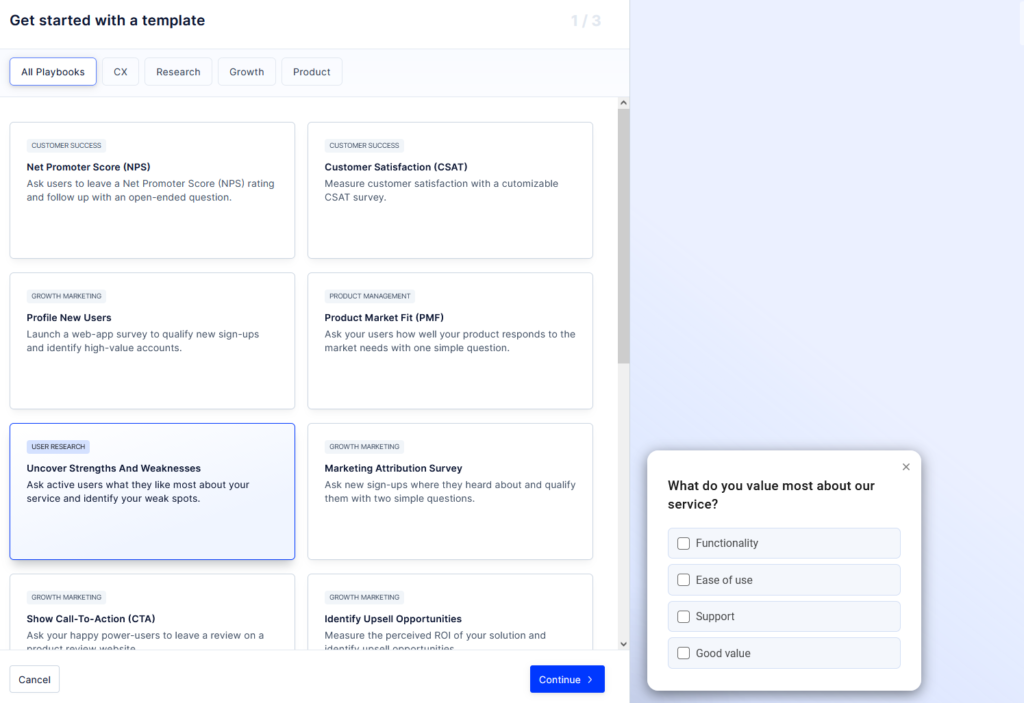

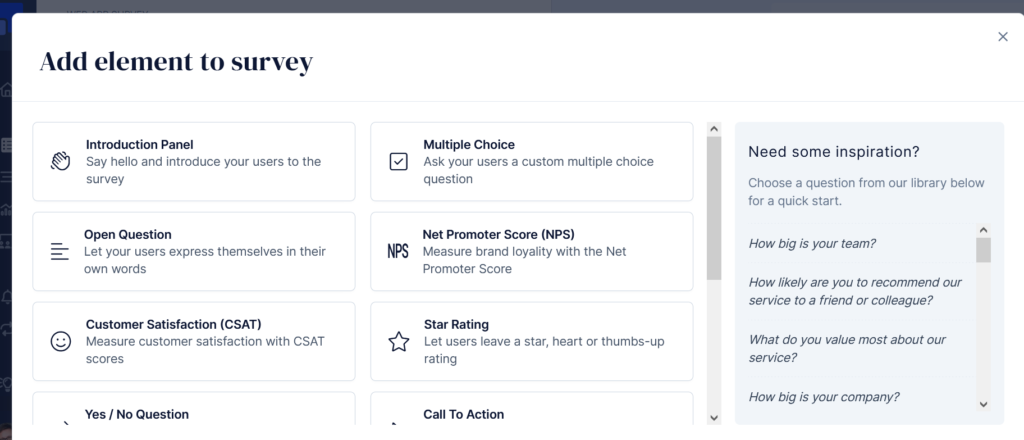

Building the survey. Only when you know your goals, target customer segments, and the type of research you’ll do can you start building the survey.

If you’re using a dedicated customer feedback survey platform like Refiner (disclaimer – this is my tool), then you can start with dedicated UX survey templates and have your first research live in minutes.

You can also create a new survey from scratch but even in this case, the process is relatively simple.

- You need to select the delivery method for your survey (i.e., display it in-app, in a mobile app, or send it to users via email.)

- Specify your survey questions

- Customize widget design, if necessary, and

- Specify whom you’d like to collect feedback from, and your target audience.

Publish the survey and start monitoring the feedback. Once the survey is set, you’re ready to push it live. And depending on your delivery method, customers might start seeing it almost instantly (for example, if you’ve decided to share it inside your app.)

Naturally, you might have to wait a bit for initial responses to start coming in. Nonetheless, that’s how quickly your survey can go live.

Introducing Refiner, a dedicated customer feedback survey tool for SaaS and digital products

Refiner (again, this is my tool) is a platform built to help you capture actionable product & user feedback with in-product micro surveys.

With Refiner, you can:

- Measure NPS, CSAT, CES, and other CX insights

- continuously research users,

- assess product-market fit, and more.

In fact, Refiner empowers you to run any type of survey and precisely target the right users at the right time.

Here are just some of the Refiner’s capabilities that will help you run better UX research surveys:

- Extensive library of survey templates

- Advanced widget customization options

- Advanced audience targeting and segmentation

- Launch triggers

- Conditional logic

- The ability to run recurring surveys

- Follow-up mode

- In-app, mobile, and email survey delivery

- Reporting dashboard

- Slack and email alerts

- Integrations, and more.