How Long Should an NPS Survey Be and How Many Questions You Should Be Asking

Are you planning to run an NPS survey but aren’t sure how many questions to include there?

Good news – Below, I’ve explained how long your survey should be to generate high response rates. I also discuss how to use survey logic to strike a healthy balance between what you want to find out and how many questions your audience is willing to answer on a single survey.

It’s a lot to cover so let’s get right to it.

How long should an NPS survey be?

I admit that, at first sight, this question may seem a little tricky. NPS is known to be a single-question survey, after all, and that pretty much answers it, right?

Well, not quite.

NPS is based on a single question. It’s usually a variation of “On a scale of 0 to 10, how likely are you to recommend [PRODUCT] to friends or family?”

As I said, the question can be a variation of the above. But in general, the primary NPS question asks for the likelihood of a person being willing to recommend your product to others.

But note I called it the primary NPS question. That’s because it isn’t the only one. In fact, depending on your goals, you could follow it up with several other questions. We refer to them as NPS follow-up questions.

Needless to say, usually, it’s those questions that cause problems when constructing an NPS survey.

It’s easy to be tempted to ask for too much in an NPS survey

The primary NPS question provides one important insight – It shows you how many satisfied customers you have and as a result, how well your product responds to the audience’s needs.

It does so by dividing your customers into three groups:

- Promoters – Highly satisfied customers who would be more than willing to tell others about you. In fact, many have most likely done so already.

- Passives – Satisfied customers but not satisfied enough to scream about you from the rooftops.

- Detractors – Unsatisfied customers who might talk about you but only in negative terms.

This is a powerful insight to have, right?

It helps you evaluate your customer satisfaction. It tells you how well your product matches the audience’s expectations. It can also help you predict the potential for word-of-mouth and referral growth.

But it doesn’t tell you why those people answered the way they did.

You can’t tell what makes someone so enthusiastic about your product. You don’t know why another person is happy with your product but isn’t over the moon about it. And you have no way of knowing why someone is borderline raging about you.

You need to follow up to find out, and that’s where the problem starts.

Why? Because it is so easy to want to probe deeper and deeper. But in reality, no customer will want to spend much time responding to your survey. If they answered the primary question, you’re already lucky. Any more insights from them are a bonus.

So, if you keep presenting customers with more and more questions, you’re going to lose them along the way.

(Not to mention that with too many follow-up questions, you’re bound to start asking about irrelevant things eventually.)

So, how many questions to include in an NPS survey?

Short answer – No more than two. The primary NPS question and one follow-up.

Long answer – No more than two per customer. Every customer will see the primary NPS question and you might ask them a specific follow-up based on their answer. This means that you’ll prepare a whole range of follow-up questions and will trigger the right one using survey logic.

What is survey logic?

The term – survey logic – refers to the use of conditional branching and skip patterns in surveys.

When you use survey logic, you allow subsequent questions or sections to be determined based on respondents’ previous answers.

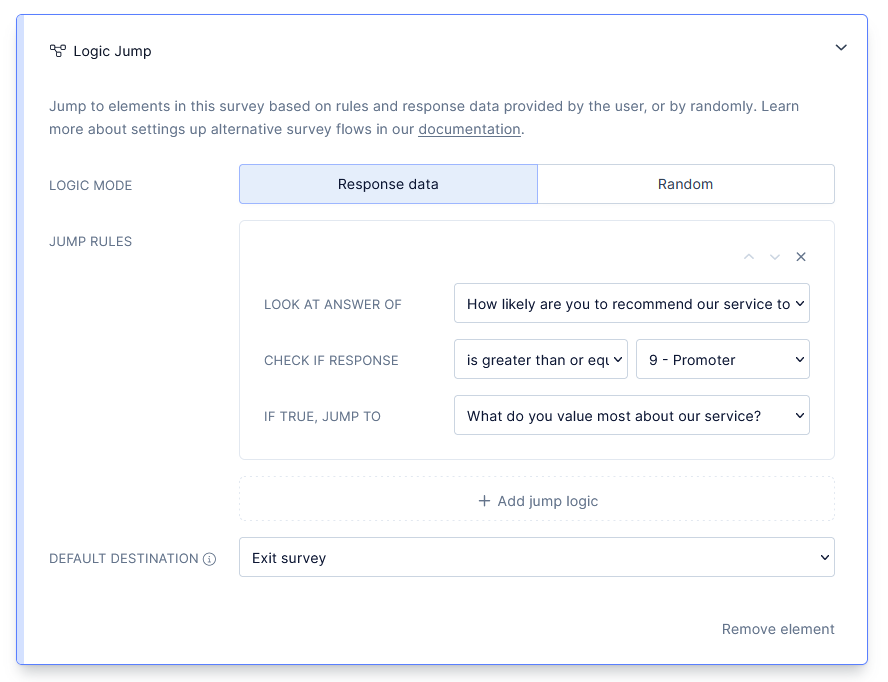

Here’s an example of a survey logic jump that defines criteria for displaying a particular follow-up question. In this case, only users who responded with 10 will see the question.

EXAMPLE: This survey logic defines criteria for displaying a particular follow-up question. In this case, only users who selected 9 or 10 in an NPS survey will see the follow-up question.

This is how I’ve set it up in Refiner:

- Look at answers of: This option defines what question precedes the survey logic. In other words, the logic jump initiates after the person has answered the question.

- Check if response: This is the actual survey logic. In this case, the logic jump continues if the person has answered the question with nine or above.

- If true, jump to: That’s the destination for the logic jump. In this case, it’s the follow-up question. (Note that I also specified the default action for users who don’t match the logic jump criteria. In this case, they will go straight to the end of the survey (see the Default Destination: Exit survey option at the bottom of the screenshot.)

Thus lies the beauty of survey logic – It allows you to easily strike a balance between obtaining highly-valuable feedback and keeping the survey concise.

For one, you can ask relevant questions to different user groups. You can find out what Promoters love about your product the most. You can trigger a separate follow-up question to find out where your app fell short and find out what makes Detractors dissatisfied with it, and so on.

But in spite of having so many potential questions, your customers will always see just two options – the primary NPS question and a relevant follow-up.

There is one other thing we must discuss, though…

Your survey’s length is affected not only by the number of questions you ask. And it’s a hugely important thing to know.

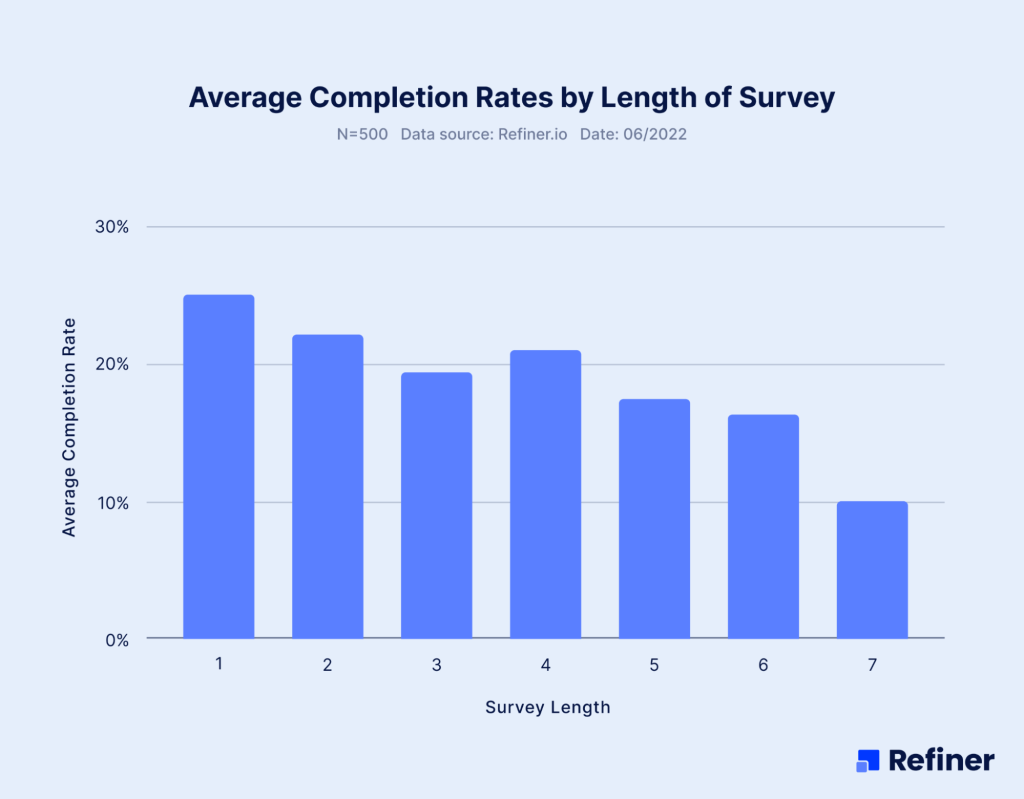

The length of a survey will directly affect its completion rate. There’s plenty of data to prove it. Our internal research, for example, proved that completion rates drop with every question you add to the survey.

But….

There are two additional factors that can make your NPS survey seem endless (in a bad way!), even if you included only two questions there.

The first factor is the type of question you ask and the amount of effort someone needs to put into replying.

Look at the primary NPS question again.

It’s so ridiculously easy to answer, right? All you have to do is to select a value, and you’re done.

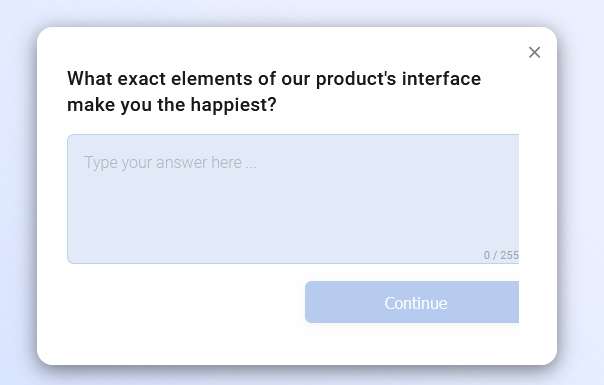

Next, compare it with this potential follow-up question.

Now, I admit it – The actual question is ridiculous. No one would have asked that (erm, at least I hope so…), but that’s not the point. The point is that it probably made you think in terms of “What the heck?!”

It’s a difficult question to answer, after all. It requires you to think, remember the interface, review it, see if there are any elements that you prefer to others… In short, it requires work. An awful lot of work.

I don’t think anyone would be willing to invest their time into doing it.

The same goes for this example.

Again, no sane person would have the time or desire to review eleven different options, make a decision on them, and provide their reply.

They’d just abandon the survey instead.

But note that in either scenario, our survey was only two questions long – The primary NPS question and a follow-up. And yet, it turned out to be too long for anyone to answer.

The other factor is the question’s relevance to the survey.

In short, unless your follow-up question directly relates to a.) the topic of the survey and b.) the person’s response to the primary question, they are going to abandon it. It’s that simple.

Luckily, this factor is easy to eliminate with survey logic. Sure, you might need to set up some additional options. But at least in doing so, you’ll reduce the potential of a customer seeing an irrelevant follow-up.

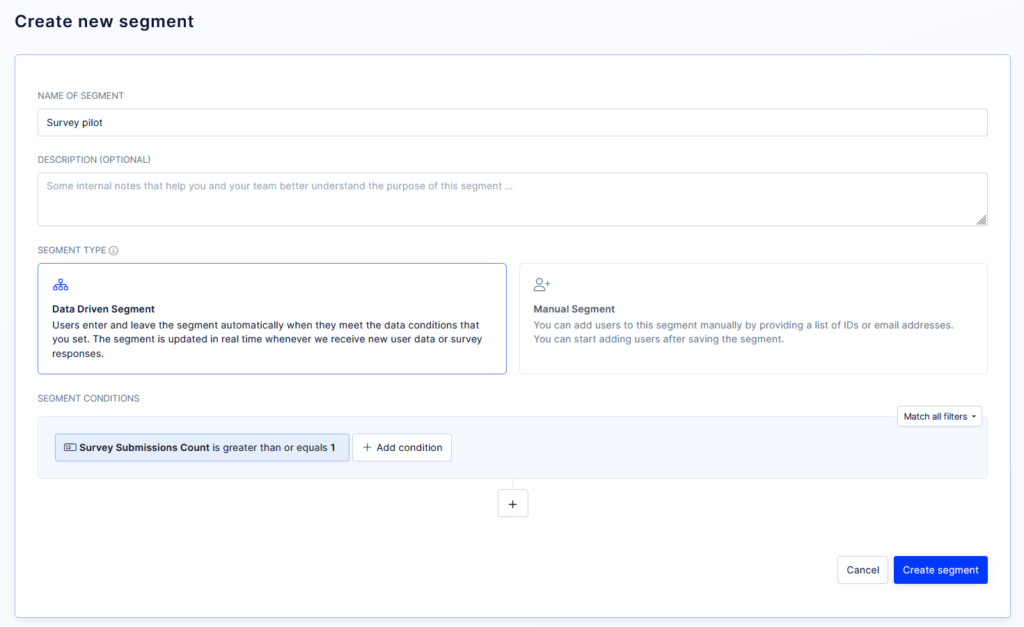

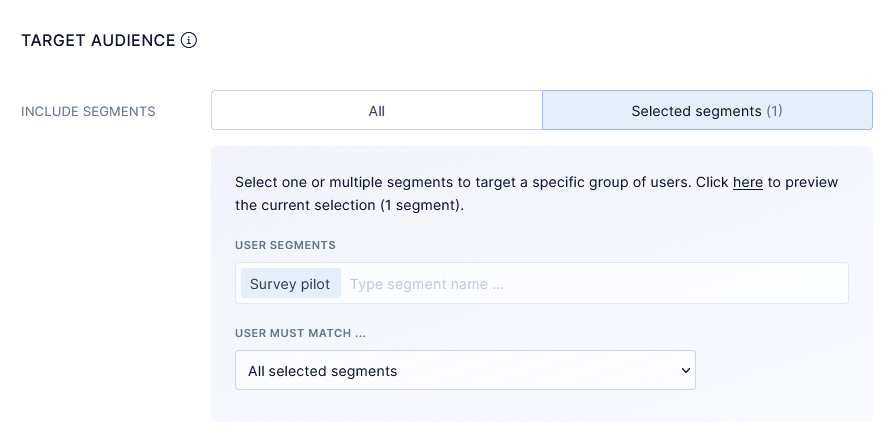

PRO TIP: Run pilot tests – initial runs of your survey that you conduct with small groups of respondents only – to identify any potential issues with your survey length or question clarity.

The easiest way to do it is by creating a “test segment” and delivering your survey to those users initially. This is how the setup looks like in Refiner.

With the segment created, I can quickly trigger my new survey to that segment only.

And that’s it.

Now you know how long your NPS survey should be, how many questions to ask, and how to use survey logic and branching to make the survey more relevant.

All that’s left is to launch your first NPS survey.